- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 647-8892 today.

TAX PENALTIES

Do’s & Don’ts of Requesting IRS Penalty Abatement

Taxpayers hate paying IRS penalties. Unfortunately, most taxpayers assessed an IRS penalty do not request relief or are denied relief because they do not follow some basic do’s and don’ts

In some cases, requesting post-filing relief or “abatement” of penalties is not practical. However, for two of the most common IRS penalties, relief is available if you follow some simple rules for requesting and securing abatement.

Common IRS penalties

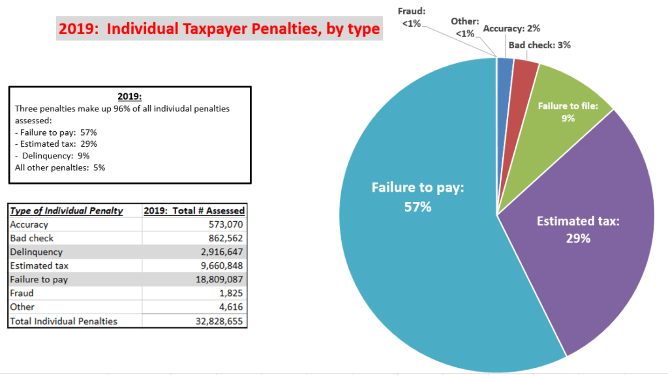

There are over 150 different IRS penalties for late filing, late payment, return errors, and other noncompliant activity. However, the three most common IRS penalties are related to late filing and late payment of taxes. The penalties are:

- The failure to file penalty: 5% per month on the balance due, maximum of 25%.

- The estimated tax penalty: Equal to the interest lost by not having sufficient withholding or paying estimated taxes throughout the tax year.

- The failure to pay penalty: 0.5% per month of balance due, maximum of 25%.

In 2019, these penalties made up 95.5% of all IRS civil penalties for individual taxpayers.

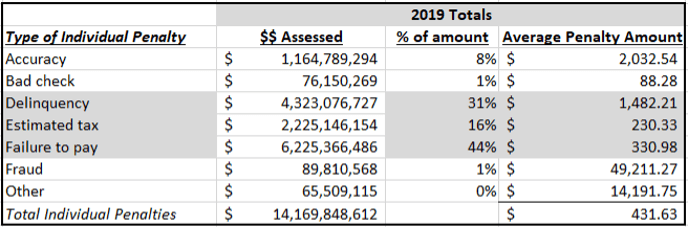

These penalties can be costly. The average penalty amounts for 2019 for individuals were:

Relief from IRS penalties

Taxpayers can request relief from penalties. For the failure to file or pay penalty, taxpayers can request that the IRS “abate” the penalties. Abatement is simply removing the penalties after they are assessed to the taxpayer. Failure to File (FTF) and Failure to Pay (FTP) penalties generally require abatement because the IRS assesses these penalties electronically (through its computer systems) when a return is filed, or a transaction is made on a balance due account.

Other penalties generally require different procedures to request relief. For example, the estimated tax penalty is generally not “abatable” by the taxpayers. Rather, taxpayers can request an exclusion from the penalty when filing their tax return (individuals use Form 2210).

Other penalties are proposed during IRS audits and investigations. These include accuracy or fraud penalties, and usually require the taxpayer deal with IRS auditors or appeals officers prior to the assessment of the penalty. Taxpayers can request abatement of return accuracy penalties after they are assessed, but the abatement process may require using special IRS procedures or taking the IRS to court. This can take years to resolve.

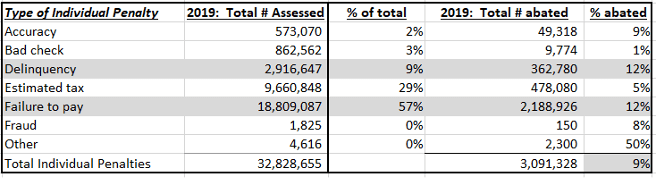

Few penalties are abated each year

In 2019, only 12% of the FTF and FTP penalties were abated. For individual penalties, only 9% were abated.

There are several reasons for the low abatement rate. First, many taxpayers do not ask for abatement. Second, if they do ask, the IRS commonly denies many initial abatement requests. Finally, taxpayers may not appeal the adverse determination from the IRS. Taxpayers who want to request penalty relief for the FTF and FTP penalties need to follow some simple rules to increase their chances for success.

Increase your chances of FTF and FTP penalty abatement

For the FTF and FTP penalties, the IRS has two primary reasons that it abates these penalties:

- Reasonable Cause Relief (RC): Where the taxpayer can show that they used ordinary care and prudence, but they could not comply (file or pay on time) due to unforeseen circumstances outside of their control (“Reasonable Cause” excuse for noncompliance).

- IRS’s First-time Penalty Abatement Relief (FTA): Can be used to abate both the FTF and FTP penalties for a taxpayer in good standing (filed all returns, paid all taxes or in an IRS agreement on the balances owed) with clean compliance history (no penalties in past three years prior to the penalty year).

When requesting FTF and/or FTP penalty relief, it is important to follow some best practices. Here are some do’s and don’ts when requesting abatement for the FTF and FTP penalties:

The “Do’s”:

- Always utilize FTA: All first-year FTF and FTP penalties, regardless of whether the taxpayer qualifies for reasonable cause abatement, are allowed to use FTA. Taxpayers, if they qualify, should call the IRS and request abatement of any FTF or FTP penalty that qualifies for FTA. All FTA requests can be done by phone, regardless of the amount of the penalty assessed

- Request reasonable cause in writing: Taxpayers often try to call the IRS to request penalty abatement. This works all the time for FTA. However, phone requests rarely work for reasonable cause abatements. Taxpayers can complete Form 843: Claim for Refund and Request for Abatement, and attach their rationale and evidence to support their reasonable cause claim. Note: the IRS will take Form 843 or a letter from the taxpayer. Form 843 is preferable because it contains the minimum requirements to identify a penalty abatement request.

- Appeal adverse determinations: Many IRS penalty abatement determinations do not consider the totality of the taxpayer’s circumstances. If any of the criteria, on its own merits, does not qualify the taxpayer for abatement, the other reasons may be ignored. This occurs because the IRS has a computer tool to assist in penalty abatement determinations that is flawed. Many reasonable cause requests are rejected due to this flawed IRS tool. Taxpayers should request an appeal so that a live person can hear all of their circumstances and make an informed decision.

- Be sure to include these items in a reasonable cause abatement request: First, be clear on specific circumstances that were outside your control that caused the noncompliance (illness, incapacitation, lost records, etc.). Second, be able to demonstrate how other situations in your life were affected by the reasonable cause. For example, the illness that caused you not to file on time may have also kept you from working. Lastly, make sure you provide specific evidence and a chronology of events for the time period of non-compliance. For example, a timeline of an illness and a doctor’s letter showing your incapacitation and inability to perform normal activity supports reasonable cause due to an illness.

- Show prior compliance: IRS Policy Statement 20-1 states that the IRS should use penalties to deter noncompliance. Taxpayers should also be prepared to explain any small amounts of prior year penalties. Here is a common example: a taxpayer has reasonable cause for late filing their 2018 return but does not qualify for FTA due to a small FTP penalty on a 2015 return. If this taxpayer has reasonable cause for late filing, they should highlight their past compliance history and explain the small FTP circumstances in a prior year. A prior positive compliance history will weigh in favor of reasonable cause abatement for the 2018 return.

- Follow up on abatement requests: Sometimes IRS penalty abatement requests are lost within the IRS. Abatement requests cannot be tracked on an IRS transcript. How does a taxpayer know if the IRS is actively working their request? They have to call the IRS. If the IRS does not have your abatement request, you will need to refile it. Taxpayers with multiple lost requests should go to the Taxpayer Advocate’s office to intervene. The Taxpayer Advocate cannot make the abatement decision, but they can make sure that your request is not lost again. One other important action: if the penalty is not paid, taxpayers should make sure that the IRS has put a “collection hold” on their account while the abatement request is being worked.

The “Don’ts”:

- Do not pay the penalty: Paying the penalty before requesting reasonable cause may remove an important IRS appeals avenue: The Collection Due Process or “CDP” hearing. Taxpayers who have an unpaid balance can eventually request a formal CDP hearing on an unpaid penalty. In a CDP hearing, the IRS will thoughtfully consider a penalty abatement request, increasing the chances for abatement. Also, CDP hearings have another advantage: they can take much less time than informal IRS Service Center penalty abatement appeals hearings.

- Don’t use these two reasonable cause excuses for FTF: The IRS will reject any FTF penalty abatement based on reliance on a Tax Pro and financial hardship. The IRS has strong backing for these decisions based on court rulings. FTF abatement requests using these criterion receive a quick adverse determination letter from the IRS and little consideration from IRS appeals.

- Don’t forget to request timely abatement before the statute expires: Taxpayers can generally request abatement of penalties within the normal refund statute of limitations which is three years from the date the return was filed or two years after the penalty was paid. In the past, the IRS has sometimes allowed abatements past the refund statute expiration date. However, the IRS has corrected this system flaw and most requests outside of these timeframes are met with rejection by the IRS. Taxpayers who complete an IRS installment agreement and qualify for FTA should request abatement of the FTP penalty within two years after the payment arrangement.

Timing expectations

Successful penalty abatement can take some time. FTA can be approved by phone instantly. However, the final reduction of the penalty will take place in about three weeks. Taxpayers should always review their account to make sure the IRS correctly abates the penalty. Taxpayers can review their account transcript for the years in question to verify the abatement.

Abatement for reasonable cause can take a considerable amount of time, depending on whether an appeal is needed. Initial penalty abatement requests usually take 2-3 months for an initial determination. If an appeal is required, it can add 6-12 months to the process. For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.