- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

Filing your taxes

What is adjusted gross income (AGI)?

One of the questions tax professionals get most is: What is Adjusted Gross Income? This is a term you’ll see throughout personal income taxes, and it’s critical in determining how much money you’ll get back—or pay—when tax time rolls around. Read more to find out all about what AGI is, how AGI is calculated, what MAGI is, and which credits or deductions may be available to you, depending on your AGI.

AGI defined

AGI is gross income minus certain adjustments to that income, according to the IRS. Gross income refers to the total income received by taxpayers before taxes and other deductions.

Your AGI is extremely important because it’s the basis for figuring out your taxable income. The lower your AGI, the lower your taxes. A Jackson Hewitt Tax Professional can help you with this process to ensure that you’re capturing all possible deductions, but we’ll go through more below.

How to calculate AGI

To calculate AGI, you would include your various streams of income, as reported to the IRS by your employer on Form W-2 or self-employment income less deductions, plus other income, such as investment dividends and miscellaneous income, normally reported on Form 1099.

Next, you add any taxable income from other sources, such as unemployment compensation, pensions, taxable Social Security payments, and any other income from any source you received during the year. You’d then subtract certain deductions, or “adjustments” that you’re eligible to take. The result is your AGI.

The formula for finding your AGI includes income from:

- Various jobs

- Investments

- Real estate

- Taxable Social Security

- Unemployment

- Pensions

- Businesses

- Farms

- Other miscellaneous income such as Alaska Permanent Fund Dividends, Gambling winnings, Bonuses and other income not reported anywhere else on Form 1040 or Schedule 1

And then subtract:

- Educator expenses

- Certain business expenses

- Deductible health savings account (HSA) contributions

- Moving expenses for military

- One-half of self-employment (SE) taxes

- Contributions to retirement plans or health insurance for self-employed people

- Penalties on early withdrawals of savings accounts such as a CD

- Deductible IRA contributions

- Student loan interest

- Deductible tuition and fees

From there, you can either take the standard or itemized deductions to help reduce the tax you pay, depending on your specific situation. These are examples of some of the factors going into figuring out your AGI, and there may be more options available to you. A Tax Pro can always help you with these calculations and which forms you may need.

Standard versus itemized deductions and AGI

Tax deductions, often called tax write-offs, can help deduct a certain amount of your taxable income. As part of the Inflation Reduction Act, the standard deduction for married couples filing jointly for tax year 2024 rises to $27,700, up $1,800 from the prior year.

For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2023, up $750. And for heads of households, the standard deduction will be $21,900 for tax year 2024, up $1,100 from the amount for tax year 2023.

|

Filing Status |

2023 |

2024 |

|

Single, or Married Filing Separately |

$13,850 |

$14,600 |

|

Married Filing Jointly & Surviving Spouses |

$27,700 |

$29,200 |

|

Head of Household |

$20,800 |

$21,900 |

Standard deduction amounts for 2023 and 2024 taxes

If your total itemized deductions exceed the amounts above, you may consider itemizing. If you have less than the standard deduction to write off, stick with the standard deduction unless tax law doesn’t allow it in your tax situation. A Jackson Hewitt Tax Pro can help determine what is best for your specific situation.

The IRS also provides a list of itemized deductions to report on Form 1040, Schedule A and the requirements for claiming various deductions on Form 1040, Schedule 1.

Some of these include:

- Educator expenses

- HSAs

- Several self-employment costs, such as retirement plan contributions, health insurance premiums, and half the self-employment tax as reported on Schedule SE

- Savings withdrawal penalty amounts

- Student loan interest

- Tuition and other education expenses

- The traditional IRA deduction

- Moving expenses for certain members of the military

- Costs incurred by military reservists, performing artists, and fee-based government officials.

You can work with your Tax Pro to see what other deductions may apply to you and your family.

The impact of AGI on tax returns

AGI is critical in figuring out many credits and some of your allowed standard deduction amounts, even what your eventual tax bill—or refund—may be.

For tax year 2024, the top tax rate remains 37% for individual single taxpayers with taxable incomes greater than $609,350 ($731,200) for married couples filing jointly). The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

Here’s a complete list of the rates:

- 37% for incomes greater than $609,350 ($731,200 for married couples filing jointly)

- 35% for incomes over $243,725 ($487,450 for married couples filing jointly);

- 32% for incomes over $191,950 ($383,900 for married couples filing jointly);

- 24% for incomes over $100,525 ($201,050 for married couples filing jointly);

- 22% for incomes over $47,150 ($94,300 for married couples filing jointly);

- 12% for incomes over $11,060 ($23,200 for married couples filing jointly); and

- 0% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

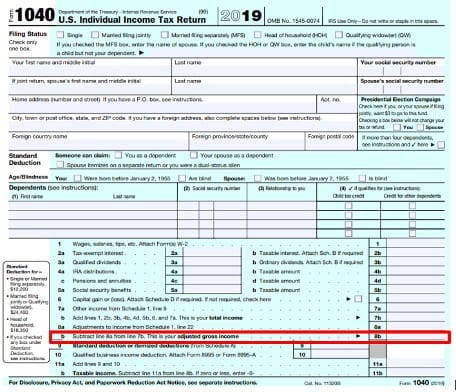

How to find AGI on tax forms

Your AGI for the previous tax year may be used to confirm your electronic return with the IRS. It’s important to keep those documents when filing. To find your AGI, you’d look at your previous year’s tax return.

If you filed IRS Form 1040, your AGI will be listed on Line 8b.

What is Modified Adjusted Gross Income (MAGI)?

While AGI is crucial, Modified Adjusted Gross Income (MAGI) may be necessary to figure out if you’re eligible for certain deductions and credits, such as the Child Tax Credit, Lifetime Learning Credit, government health care plans, and certain retirement plans.

To get your MAGI, you start with your AGI and depending on your return, you may have to modify it by adding or subtracting certain elements. MAGI is your AGI plus these, if any: tax-exempt foreign income, non-taxable Social Security benefits, and tax-exempt interest. MAGI calculations can be different for each tax situation where it is used. Your Tax Pro is always there to work with you to see whether you will need to calculate your MAGI.

It’s important to note that:

- For many people, MAGI is identical or very close to AGI.

- MAGI doesn’t include Supplemental Security Income (SSI).

- MAGI doesn’t appear as a line on your tax returns.

- MAGI is used to calculate various tax situations.

AGI, MAGI, and program eligibility thresholds

We’ll go a little more in depth about how your AGI and MAGI thresholds will dictate your eligibility for certain tax deductions and credits.

Child Tax Credit and MAGI

Use MAGI to claim tax credits, such as the Child Tax Credit. You can claim the full Child Tax Credit if your MAGI is under $200,000—or under $400,000 if you and your spouse file a joint return. If your MAGI is greater than $200,000 ($400,000) the credit is reduced by $50 for each $1,000 over the threshold amount.

MAGI and the Lifetime Learning Credit

If you paid expenses related to college, graduate, or vocational school, you may claim the Lifetime Learning Credit. This is a non-refundable credit of up to $2,000 (per return) of qualified tuition, fees, and expenses you paid for yourself, spouse, or a dependent. You do not have to be in a degree program, a full-time student, or in the first four years of post-secondary education. In addition, your MAGI cannot be more than $90,000 if single, or $180,000 for married couples filing a joint return.

MAGI and government health care plans

MAGI is also used to determine eligibility for healthcare waivers and incentives under the Affordable Care Act (ACA) for states' health insurance marketplaces. It is also used as a threshold for qualifying state Medicaid programs. It’s also used to figure out eligibility for the Children's Health Insurance Program (CHIP), among other initiatives.

Roth IRA and MAGI

MAGI is also used to decide your eligibility to contribute to a Roth IRA. Roth accounts use after-tax dollars and grow tax-exempt (unlike traditional retirement accounts that are instead tax-deferred).

To contribute to a Roth IRA, your MAGI must be below the limits specified by the IRS. If you’re within the income threshold, your contribution amount is also decided by your MAGI. Your contributions are phased out if your MAGI is more than the allowed limits.

These are just some examples, but there are many others that a Jackson Hewitt Tax Pro can help you with.

Self-employed workers and AGI

There have been some changes in the past few years that affect self-employed workers. The Tax Cuts and Jobs Act of 2017 (TCJA) ended the ability for W-2 employees to deduct unreimbursed job-related expenses from your AGI, but there are also some important additions.

Qualified Business Income deduction

In good news, the TCJA added the Qualified Business Income (QBI) deduction. If you’re self-employed or a small-business owner, you may be eligible for a deduction of 20% of eligible income before taxes. The deduction is available to taxpayers whose AGI is below $241,950, or whose joint taxable income is less than $483,900, in 2023.

QBI includes income from a trade or business, like rideshare driving, e-commerce or online retail, consulting, or reselling income. It does not include wages earned as an employee or business-generated capital gains, interest, and dividend income.

This is just one piece of the tax puzzle for those with self-employment income. A Tax Pro can help you with your specific situation if you’re self-employed or have side gig income.

What’s the difference between Adjusted Gross Income and Net Income?

Net income is the amount an individual or business makes after deducting costs, allowances and taxes. For side gigs and other self-employment income, it is the total income from a business minus expenses such as cost of goods sold, general and administrative expenses, operating expenses, depreciation, interest, and taxes.

One key difference is that net income is used for both businesses and individuals, while AGI is only applicable to individuals.

As mentioned above, gross income is the entire amount of money an individual makes, including wages, salaries, bonuses, and capital gains from your investments. While AGI, and MAGI, is an individual's gross income after accounting for total income minus allowable deductions and adjustments.

Your AGI is crucial in figuring out how much you may pay or receive when tax time comes around. Question? We are here for you. Find one of our Jackson Hewitt Tax Professionals near you who can help with all your questions year-round.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.