- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

Employment

How to Budget for Taxes as a Freelancer

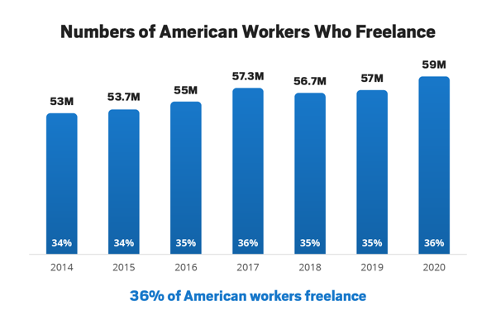

More people are freelancing than ever before. With the rapid growth of remote work and the gig economy, there’s a good chance you’ll work as a full-time or part-time freelancer in your lifetime.

According to My Credit Summit, the gig economy has grown to over 73 million workers and is expected to be over 90 million by 2028.

Freelancers, independent contractors and gig workers are all defined as “self-employed individuals” in the eyes of the IRS. There are distinctions between the three classifications for self-employed individuals, but they all have the same tax requirements. Freelancers, independent contractors and gig workers are all required to file a Schedule C to report their income and expenses and a Schedule SE to pay their Social Security and Medicare taxes when they file their tax returns.

If you work as a freelancer in any capacity, you may have questions regarding taxes on your income. Some tax questions you may ask include:

- How much should self-employed taxpayers save for taxes?

- How much should a self-employed taxpayer set aside for taxes on their income from a Form 1099-NEC?

- What happens if self-employed taxpayers file their taxes incorrectly?

This guide will highlight some key considerations for budgeting taxes as a freelancer, along with ways to get help navigating your taxes.

Tax tips for part-time self-employed taxpayers

If you’ve worked for a traditional employer, you’re probably familiar with a W-2 form. This form is required of any employer that pays wages to an employee. W-2 forms don’t have a minimum reporting requirement.

A Form 1099-NEC is the form a business sends for a non-employee contractor paid $600 or more during the year. If you’ve freelanced and earned at least $600 from a business in the past year, they should send you a Form 1099-NEC. You’ll need the form to file your taxes.

Even if you didn’t earn $600 from a single business, you’re still required to claim what you earned on your Schedule C, Profit or Loss From Business. Otherwise, you can be penalized for failing to report all of your earnings. All taxpayers must report all of their income on their annual individual income tax return.

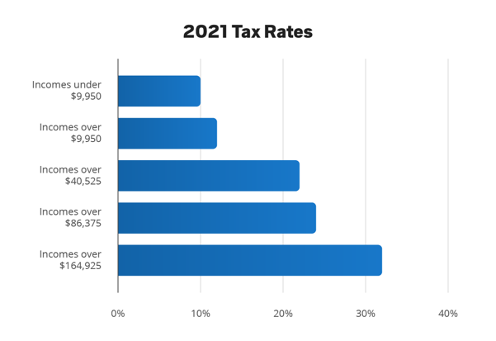

Your tax rate will impact how much income tax you’ll owe on your side gigs. To figure out your total taxes, combine anything you made from your side gigs, determine your Self-employment taxes (Schedule SE), this is a self-employed person’s share of Social Security and Medicare taxes owed on earnings. Include your total income and taxes on Form 1040.

Keep in mind that extra money from freelancing gigs could bump you up into a higher tax rate, which could result in you having to pay more for taxes. For example, for tax year 2023, the tax rate for a single taxpayer with taxable income over $40,525 is 22%, but it increases to 24% for incomes over $44,725.

Taxpayers in the U.S. are required to prepay 90% or 100% of their expected taxes through withholding (generally W-2 and 1099-R income) or quarterly estimated taxes. To calculate your payments, determine your quarterly net profit and estimate your taxes for the quarter. This will help you budget a portion from each job to help pay your quarterly estimates.

When do I need to pay freelance taxes?

The Internal Revenue Service (IRS) wants you to prepay your taxes as you make money. That’s why the Form 1040-ES, Estimated Tax for Individuals was created. This form enables taxpayers to estimate what they will owe in taxes and pay a part each quarter. While a traditional employer will withhold taxes from your paycheck and pay them to the government on your behalf, when you’re a freelancer, it’s your responsibility to pay your taxes throughout the year.

Depending on how much you freelance, you may be able to wait until you file your taxes for the year to pay what you owe, instead of paying estimated taxes prior to April 15. According to the IRS, freelancers generally have to make estimated tax payments if they anticipate owing at least $1,000 or more in taxes when their return is filed.

Your state may also require estimated quarterly taxes. If you complete one or a few low-paying freelance projects and have a high-earning full-time job, for example, you might not need to pay estimated taxes. If you want to avoid a penalty, it’s safer to pay estimated taxes each quarter based on what you anticipate you’ll owe due to your tax rate.

What about self employed: how much should I put away for taxes?

If you’re a full-time freelancer, you’ll need to pay estimated taxes to the federal government and to your state government (if applicable) each quarter, based on your income. Estimated tax payments are easier to manage if you base your taxes on the previous year’s income. Simply divide what you made into four equal estimated payments and pay those amounts each quarter. This process will help you avoid a penalty but you will have to pay any shortfall when you file your taxes.

If you’re making considerably less than you made last year, you may be able to lower your payment based on what you make each quarter. However, the IRS says in general, taxpayers must pay at least 90% of their tax bill during the year to avoid an underpayment penalty.

If you’re making more, you may want to pay more on your estimated taxes. Paying an accurate estimated tax will help you minimize what you owe when you file your taxes. If you pay more in estimated tax than what you’ll actually owe based on what you make, you may receive a tax refund when you file.

Freelancers should also be aware of self-employment tax, which you’re required to pay if you make at least $400 a year. This amounts to 15.3% of your net business profit and accounts for Social Security and Medicare taxes on the first $160,200 you make, and 2.9% on anything you make above that. Normally, if you’re a full-time employee, your employer would pay half of this tax as an equal contribution. When you work for yourself, you are the employer, so you’re responsible for the entire tax burden.

The good news is that you’re able to deduct the employer-equivalent portion of your self-employment tax when you calculate your adjusted gross income. That can lower what you owe on income tax. What you owe on the self-employment tax will factor into what you pay on your estimated taxes.

For freelancers who are freelancing full-time for the first time, use what you make each quarter to calculate your estimated tax payment. It can help to put away an amount based on your anticipated tax rate and self-employment tax (or higher) from each payment, so you have what you need for your estimated tax payments.

To account for both the self-employment tax and taxes you owe on income, it’s helpful to set aside at least 30% of your income for taxes if you’re freelancing full-time for the first-time. Otherwise, you can use last year’s income to calculate an estimation of what you’ll owe this year.

Ways to lower your freelance taxes

It may be helpful to overestimate what you’ll owe throughout the year so you budget at least what you need for taxes. But when you file your taxes each year, there are ways you can save as a freelancer. Keep the following tax considerations for the self-employed in mind.

- You may be able to deduct vehicle expenses. If you drive to meet clients, you may be able to deduct expenses like gas, insurance, cleaning, repairs and beyond. Track your mileage and keep your receipts for vehicle expenses.

- Marketing costs may be deductible. Expenses like website creation, business cards and digital ads for your freelance business could be deductible. Be sure to itemize your marketing costs to take advantage of these deductions.

- You might be able to deduct home office space. If you work from home, the costs associated with your office space may be deductible if you have a dedicated space just for work. Also, equipment like a new laptop or services like cell phone plans could help you save on your taxes.

There are numerous other potential self-employed deductions, including health insurance premiums, travel deductions and education. It’s generally helpful to track all of your expenses and keep receipts for anything that may have gone toward your business. Then, work with a tax professional to maximize your deductions as a freelancer.

You may be wondering if you should factor deductions into your estimated tax payments. If you’re a seasoned freelancer or independent contractor with a good idea of your deductions’ value, this may be a possibility. If freelancing is new to you, you may want to estimate their value at a low level, if at all, so you don’t risk underpaying on estimated taxes and have to pay a penalty.

Taxes are a serious part of freelancing

Freelancing provides a lot of benefits for many workers, in terms of flexibility in work hours and location and the freedom to choose the clients you want to work with. A successful freelance career also requires meeting legal and financial obligations, like paying what you owe in taxes.

Taxes for freelancers get easier with experience. But in most cases, it helps to work with a tax professional. They’ll help you get a better idea of the amount you should budget for and help you maximize your deductions and tax savings and avoid tax penalties.

Read more articles from Jackson Hewitt

Get a Tax Pro

Our Tax Pros are ready to help you year-round. Find an office near you!

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 60+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.