- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 357-8933 today.

BACK TAXES AND TAX DEBT

Will the IRS accept more offers in compromise post-COVID? Here’s why and why not

The IRS offer in compromise (OIC) has always been a program that generates much controversy and confusion. Right now, there are over 20 million individual and business taxpayers who owe the IRS, but few get an OIC.

There are actually 3 types of OICs:

- OIC for Doubt as to Liability: a tax settlement where the taxpayer disputes the tax assessed.

- OIC for Effective Tax Administration: a tax settlement where the taxpayer and the IRS agree that the tax owed is correct and could be paid in full. However, the taxpayer requests a settlement for less than owed because collecting the tax would cause economic hardship or public policy/equity considerations warrant paying less than the amount owed.

- OIC for Doubt as to Collectability (OIC-DATC): a tax settlement where the taxpayer’s financial situation does not allow them to pay the balance owed with assets and future income.

The OIC-DATC is by far the most popular OIC. For the past two decades, it has been the subject of many radio and TV commercials claiming taxpayers can settle their tax debt for “pennies on the dollar.” In fact, OIC Mills are on the IRS’s list of the top dozen tax scams for 2020. Learn more about the realities of the OIC program to see how it’s used and abused.

A quick word about the few OICs applied for and accepted for doubt as to liability and effective tax administration (ETA): they are rarely requested, and few are approved. In fact, in 2020, the IRS approved only 531 ETA OICs. Liability challenges are often completed in IRS appeals or with audit reconsideration. So few ETA OICs are accepted that the IRS can review them all with one IRS specialty group in Texas.

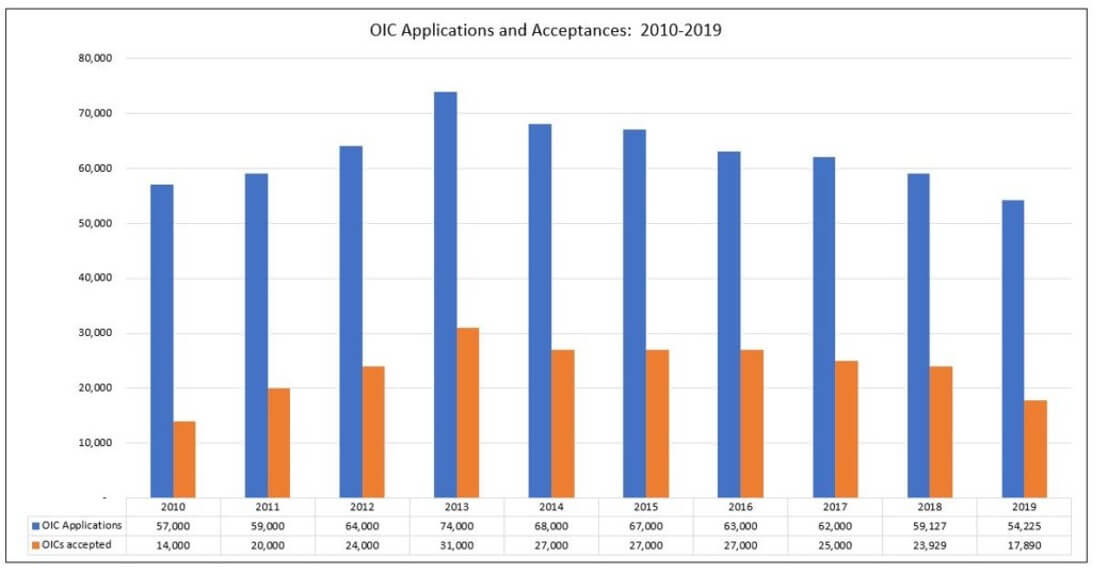

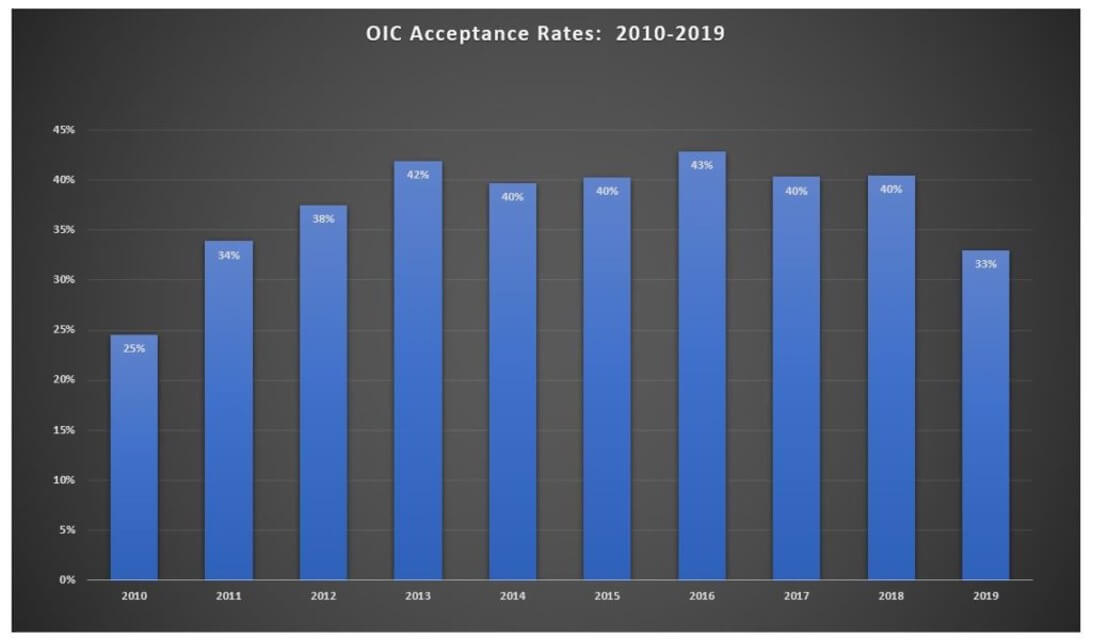

Doubt as to Collectability are the most commonly considered OICs. This IRS collection alternative is attempted by tens of thousands of taxpayers each year, and very few are accepted.

There are two main reasons that the IRS may not accept your doubt as to collectibility OIC:

- You don’t qualify.

- You can’t pay the calculated offer amount.

If you want to learn more about the fundamentals of an OIC, you can see a simple qualification and offer amount example here.

What about COVID?

The COVID-19 pandemic’s negative effect on many taxpayers’ finances raised a simple question: Will more people qualify to settle their tax debt using an OIC? IRS statistics show that the IRS accepted fewer OICs in 2020 and 2021 than pre-pandemic. In 2019, the IRS accepted 17,890 OICs. In 2020 and 2021, the acceptances dropped to 13,959 and 14,462, respectively.

Here are some reasons why it is, and isn’t, likely that the doubt as to collectibility OIC would be more accessible to taxpayers after the pandemic.

You may be able to get a doubt as to collectibility OIC if you have suffered significant, long-term financial harm that has put you in a financial situation where it would be impossible for you to pay your full tax bill in the future.

How do you define future? For the IRS, future is a projection of how much you can pay before the IRS collection statute expiration date (typically, 10 years from the date of your tax bill).

For example:

- Let’s say you owe the IRS $25,000 and have 5 years (60 months) left on the collection statute.

- You have $5,000 in assets and $100 that you can pay every month in a payment plan.

- You would be able to pay the IRS only $11,000 in the future ($5,000 from the sale of assets, plus 60 months of $100/month).

- This projected shortfall to the IRS means you would qualify for a doubt as to collectibility OIC, because there’s no way you could pay your total balance before the collection statute expires.

To qualify for a doubt as to collectibility OIC, your situation can’t be temporary. For example, if you’re currently unemployed, but you’re likely to get similar employment in the future, you wouldn’t make a good OIC candidate (assuming you weren’t a good candidate before you lost your job).

People with temporary situations and even underemployment generally aren’t good OIC candidates, because the IRS may use their expected level of income when fully employed to calculate how much they can pay (if the potential for employment is apparent).

How does the IRS challenge a temporary financial situation on an OIC application? Many taxpayers have suffered lost jobs and several months of lost income because of the COVID-19 pandemic.

In the OIC application, wage earners need to show their average, regular monthly income over the past 3 months. When submitting the application, you may show little income over the past 3 months, which could qualify you for an OIC (and likely a low offer amount).

However, the IRS offer examiner may counter with a future income figure, proposing that you show your average income over a more normalized period, like one year or more. This average may increase your collection potential by increasing your projected future income.

Unless you have a special circumstance that warrants an OIC, you would have to contest the OIC examiner’s assertions by showing that your situation is permanent. If you can’t show how your income will remain low, you may fail to qualify for an OIC, or you may be faced with an offer amount that is too high to pay to settle your tax bill.

But if the income loss appears to be permanent (for example, you lost your business, you retired, you can’t work because of poor health, or you will likely stay unemployed), it may be a good time to look closer at the OIC option.

Next steps

Taxpayers who owe the IRS and can’t pay should always consider the OIC as an option. The first step is to see if you qualify. The IRS offers the OIC Prequalifier tool on its website, but a closer examination of the facts and financials should focus on two important calculations: the qualification calculation AND the amount that you would need to pay to settle the debt (the offer amount). This helps avoid the mistake of qualifying for an OIC but not being able to pay the settlement. If this happens, you will be left looking for another solution.

To apply for an OIC, you should get all your IRS and financial information in order. This includes information such as:

- The amount of your tax debt

- The collection statute(s)

- Your compliance status

- Other relevant information for the OIC application and calculations

You will also have to review your assets, liabilities, income, and expenses to determine the amount you can pay the IRS in the future and your offer amount to settle. OIC calculations can get complicated. They involve IRS financial analysis rules, including what assets are included and excluded, and what the allowable average expenses for the taxpayer are. IRS Form 656-B, the offer in compromise booklet, and the Internal Revenue Manual section 5.8.5 offer help to taxpayers with the computations and considerations.

There may be another non-IRS option that you can use to resolve past tax debts: bankruptcy. If you’re in financial distress, you may want to consider whether bankruptcy is an alternative. You should always consult a bankruptcy attorney who is knowledgeable in determining how taxes are discharged in various bankruptcy options.

Do you have additional questions?

For help creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.