- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

Credits

20% of eligible filers miss out on the Earned Income Tax Credit

Did you know that 1 in 5 taxpayers eligible for EITC don’t claim it. Life changes like having children or employment can impact your eligibility. Don’t miss out.

The Earned Income Tax Credit (EITC) was created to provide a tax break to working people and families. Take a look at our overview of the EITC for in-depth information about this benefit. If you qualify to receive the EITC, you’re probably wondering how much your tax break will be. Our easy-to-read EITC chart can help you find out if you qualify for the EITC and how much, based on your specific situation.

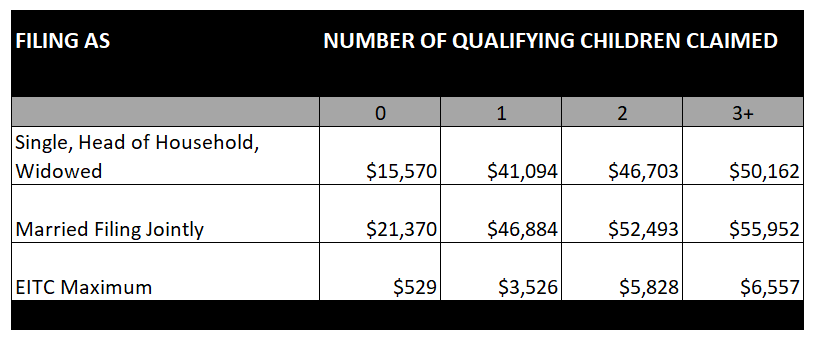

Earned income and adjusted gross income (AGI) limits and EITC amounts for 2019:

Limits on income

The IRS takes a look at your income to see if you qualify for the EITC. Income limits depend on your marital status, your filing status (for example, married filing jointly), and the number of qualifying children you claim as dependents. Both your earned income for the year and your adjusted gross income (AGI) must be less than the amount listed in the table.

Example: You are married (and must file jointly to be eligible for the EITC), you and your spouse have a combined adjusted gross income of $48,267, and you have 2 “qualifying children”. You are eligible for an EITC of up to $5,828.

Qualifying children

You don’t have to have a child to be eligible. If you do have one or more children living with you, there are standards for age, relationship, and residency that must be met in order to be a “qualifying child” for the EITC. See the IRS’ qualifying child rules and our article about claiming children as dependents for more information. Our EITC chart spells out what each child means for your tax credit.

Example: Your 20-year-old son is a junior in college and attends full time but only lived at home for three months last year. Because he didn’t live with you for at least half of the year, he is not a qualifying child. Note: Based on this information, he may still be claimed as a dependent.

Credit amount

Once you’ve calculated your income and determined how many of your children qualify you for the EITC, look at the table to find the amount of credit you could claim. Jackson Hewitt Tax Pros are available to discuss your questions and to help you get the tax credits and deductions for which you qualify. Make an appointment today at www.jacksonhewitt.com.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.