- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS Forms

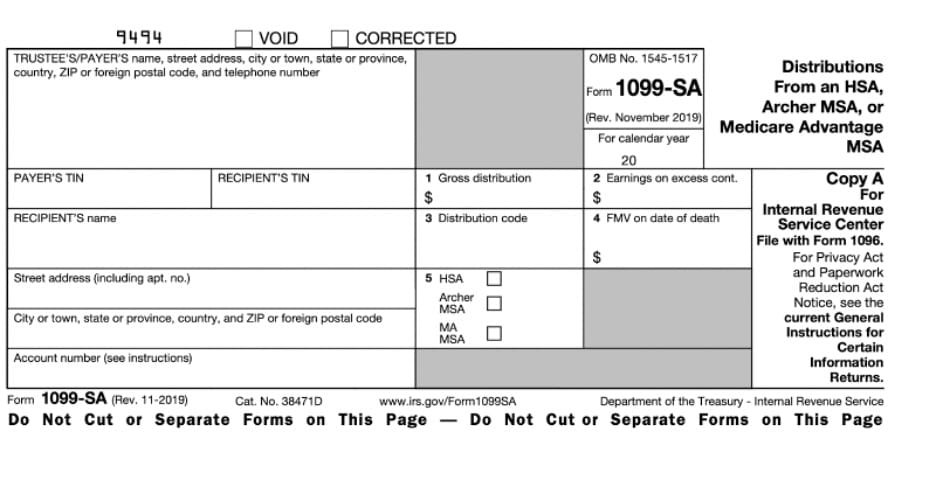

What is IRS Form 1099-SA? Distributions reported from an HSA, MSA

When you use the funds from a health savings account (HSA), or a medical savings account (MSA) you will receive Form 1099-SA to include the distributions in your federal taxes. Read more to find out more about HSAs and MSAs, how to file the correct forms, and how this may affect how much you pay—or owe--when tax time rolls around.

What is IRS Form 1099-SA?

An IRS Form 1099-SA is a U.S. tax form that reports distributions made from a health savings account (HSA), Archer medical savings account (Archer MSA), or Medicare Advantage medical savings account (MA MSA). The form’s purpose is to show you—and the IRS—how much money you spent from your account.

An HSA is a special tax-exempt account you can use to pay or reimburse certain medical expenses you incur. This means distributions and contributions for medical expenses are not taxable. You must be an eligible individual to contribute to an HSA. Most banks, credit unions, and other financial institutions can help you set up an HSA.

Who needs to file Form 1099-SA?

The financial institution that has your HSA or MSA will send you Form 1099-SA if you make contributions or receive distributions from HSAs, MSAs, and MA MSAs. You report information from Form 1099-SA on either Form 8853 or Form 8889. We go into more detail on this below.

You must file if any of the following applies:

- You (or someone on your behalf, including your employer) made contributions to your HSA during the year.

- You received HSA distributions during the tax year.

- You made ineligible contributions so you must withdraw the ineligible contributions and their earnings. This distribution is subject to a 10% additional tax.

- You acquired an interest in an HSA because of the death of the account beneficiary.

What are the 2023 HSA contribution limits?

The annual inflation-adjusted limit on HSA contributions for self-only coverage will be $3,850, up from $3,650. The HSA contribution limit for family coverage will be $7,750, up from $7,300. The adjustments are approximately a 5.5% increase over 2022 contribution limits.

HSA distributions

If you received HSA distributions, you must file Form 8889 with Form 1040 or Form 1040-SR. The IRS requires you to prepare Form 8889 and attach it to your tax return when you take a distribution from an HSA.

If you did not use the distribution for qualified medical expenses, you will pay income tax on the part you used for nonqualified expenses. Report the taxable amount on Form 8889, Line 16. You will also have to pay an additional tax of 20% on the taxable portion of your distribution, which you’ll calculate on Form 8889.

MSA contributions and distributions

An Archer MSA may receive contributions from an eligible individual and the eligible individual’s employer. Contributions by the individual are deductible, even if the individual doesn’t itemize deductions. Employer contributions aren’t included in income; therefore, you cannot use this portion as a deduction. You don’t pay tax on distributions from an Archer MSA that are used to pay qualified medical expenses.

A MA MSA is an Archer MSA chosen by Medicare to be used solely to pay qualified medical expenses of the account holder enrolled in Medicare. Contributions can be made only by Medicare. The contributions aren’t included in your income.

You report taxable and tax-free distributions from an MSA on IRS Form 8853, with Form 1040 or Form 1040-SR.

You don’t pay tax on distributions from a MA MSA that you use for qualified medical expenses.

However, MSA distributions not used for qualified medical expenses are subject to the same tax consequences as HSAs. You calculate the 20% additional tax on the taxable portion of your distributions directly on Form 8853. Taxable MSA distributions are reported on your tax return the same way that HSA distributions are.

Work with a Jackson Hewitt Tax Pro to help you with these calculations to make sure that you’re paying the right amount.

The breakdown of the IRS Form 1099-SA

The provider of your HSAs or MSAs would send you a Form 1099-SA by the end of January each year. Below is a brief snapshot of what could be included on the form.

Box 1, Gross Distribution: This would be the total distribution amount on the form.

Box 2, Earnings on Excess Contributions: The provider would put your total earnings distributed with any excess HSA or Archer MSA contributions.

In Box 3, you’d see a distribution code, outlined below:

|

1—Normal distributions |

Normal distributions to the account holder and any direct payments to a medical service provider. |

|

2—Excess contributions |

Distributions of excess HSA or Archer MSA contributions. |

|

3—Disability |

Distributions made after you were disabled. |

|

4—Death distribution other than code 6 |

Payments to a decedent's estate in the year of death or after the year of death. Should not be used with code 6. |

|

5—Prohibited transaction |

Work with your Tax Pro. |

|

6—Death distribution after year of death to a non-spouse beneficiary |

Payments to a decedent's non spouse beneficiary, other than an estate, after the year of death. Should not be used with code 4. |

If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return.

In Box 4, FMV on Date of Death - Fair market value on the date of death.

Meanwhile, Box 5 shows whether the distribution is from an HSA, Archer MSA, or MA MSA.

These are just meant as examples. A Jackson Hewitt Tax Pro can help you with your specific situation to make sure that you’ve entered all the information correctly.

Which distributions are tax-free?

HSA funds can cover deductibles, copays and coinsurance, over-the-counter drugs, and other qualified medical expenses not covered by your plan.

Usually, you can’t use HSA funds for insurance premiums. However, you can use HSA money to pay for health coverage bought under COBRA or pay health insurance premiums if you're getting unemployment payments. In addition, if you’re enrolled in Medicare, you can use HSA funds to pay premiums for Part B and Part D coverage. And at age 65 and older, you can use HSA money to cover premiums for employer-sponsored health care, if applicable.

Again, your HSA contributions are tax-free. HSA contributions are either pretax (if through an employer) or tax-deductible (if you make your own contributions). If you use your HSA money for eligible medical expenses outlined above, you won’t pay taxes on withdrawals.

Which distributions are taxable?

HSA distributions used for anything other than qualified medical expenses are not only taxable, they're subject to an added 20% penalty if you're not disabled or are under the age of 65.

Navigating the HSAs and MSAs can be complex. We are here to help you with all questions you may have. Find a Jackson Hewitt office near you.

Frequently asked questions

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.