- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

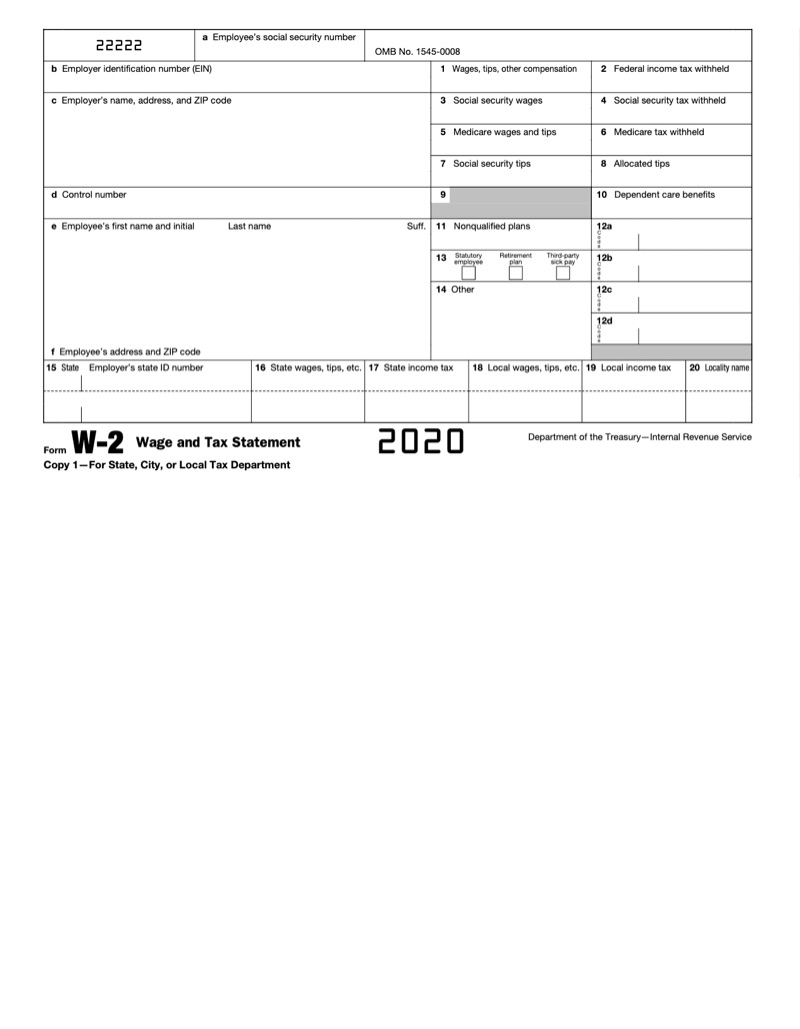

IRS FORMS: W-2

What Do You Do With a W-2 Tax Form?

The Form W-2 is a wage and tax statement that details how much you were paid by an employer during the year. If you have (or had) a job at any time of the year, you should receive a Form W-2 from each employer the following January containing income information to report on your tax return. Most Americans work for an employer. Almost 146 million tax returns reported wage income as of 2017.

The wages on your W-2 must be reported on your tax return. They are also frequently used as income verification in situations such as renting or buying a home, or applying for car loans and student aid. If you need prior W-2 forms for these applications but lost them or cannot request copies from your employer, you can request a W-2 transcript from the IRS.

I received more than one W-2 form

If you worked at more than one job in the past year, you’re likely to receive more than one W-2. Even if your W-2 reports minimal income, such as giving a new job a trial run of one day or week then deciding you’re not a good fit, the employer is still required to file one with the Social Security Administration (SSA) and send you a copy.

When you have all of your Forms W-2 on hand, you need to combine the amounts of your total wages received and report them on Line 1 of your Form 1040. It can look like they all came from one job since only the sum of all wages is reported on this line, but you still must account for all Forms W-2 you received.

The total of federal income tax withheld from these forms is reported on Line 17. If your multiple jobs resulted in an overpayment of Social Security taxes, you could receive a refundable tax credit for the overage.

What should I do if I don't receive a form from my employer?

Generally, your employer must furnish a W-2 to you by mail or electronically by February 1 for the prior tax year.

You should contact your employer if February 1 comes and you haven’t received your W-2. If you do not receive your W-2 by February 28, you may contact the IRS and tell them that you didn't receive a W-2 form. They will ask questions about the job and explain how to report without a W-2. In such case, you should keep your last pay stub so you can be sure your income is correct.

The amounts reported on my Form W-2 don’t align with my actual pay

Your Form W-2 also reports certain employee benefits you received. Some employee benefits can be taxable such as long-term disability payments.

Contributions to pre-tax employer-sponsored retirement plans, like a 401(k), are also reported on your W-2 form. While they reduce your taxable income for federal income tax purposes, you still must pay the full amount for Social Security and Medicare.

If you are still unsure whether the amounts on your W-2 are correct after tabulating your employee benefits and checking your paystubs and deposits, you should ask your employer or payroll company to verify that information. If a mistake was made, they must file a Form W-2C to correct any under or overstatements and omissions.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.