- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

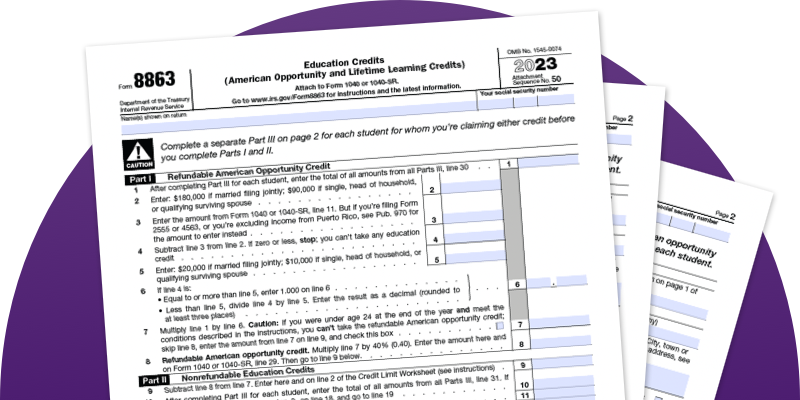

IRS FORMS: Form 8863

Form 8863: Use IRS Form 8863 for claiming education credits

What is IRS Form 8863 and what role does it play in claiming education credits on your tax return? Keep reading to learn all about Form 8863, including the credits it covers, which expenses those credits cover, and a quick overview on how to fill it out.

Key takeaways

- You’ll need to fill out IRS Form 8863 to claim the education credits on your tax return, specifically the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC or LLTC).

- The AOTC is designed to help undergraduate students in their first four years of higher education.

- The LLC is designed to help students or their families by allowing a credit of 20% of education expenses, for graduate courses, continuing education courses, or other courses.

- Both the AOTC and LLC allow you to claim costs directly linked to enrolling and attending an eligible educational institution.

- Whether you’re claiming the AOTC, LLC, or both, it’s important to ensure you fill out Form 8863 correctly. We’ll provide a basic overview to help you get it right.

IRS Form 8863: What is the IRS Form 8863?

This form helps you calculate and claim education tax credits, specifically the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits aim to reduce the amount of income tax you owe by giving you credit for qualified education expenses you paid during the year.

When you spend money on eligible school expenses, like tuition or course materials, you can use Form 8863, Education Credits, to figure out how much money you’ll claim as a credit. These credits can significantly decrease your income tax bill and make education more affordable.

American Opportunity Tax Credit (AOTC)

The AOTC is designed to help undergraduate students in their first four years of higher education. This credit can greatly reduce your income tax bill and even result in a refund. The AOTC is worth up to $2,500 per eligible student each year.

Here's how it breaks down: You can claim 100% of the first $2,000 you spent on qualified education expenses and 25% of the next $2,000. If the credit reduces the income tax you owe to $0, you could get up to 40% of the remaining amount, up to $1,000, as a refundable credit. However, it is not a guaranteed refund.

|

Amount you spend on eligible education expenses |

Percent you can claim |

Total credit |

|

The first $2,000 |

100% |

$2,000 |

|

The next $2,000 |

25% |

$500 |

The AOTC phases out for higher-income earners. For single filers, the phase-out begins at $80,000 of modified adjusted gross income (MAGI) and completely phases out at $90,000. For married couples filing jointly, these thresholds are doubled.

|

If you are... |

AOTC starts phasing out at a MAGI of... |

AOTC completely phases out at a MAGI of... |

|

Single |

$80,000 |

$90,000 |

|

Married filing jointly |

$160,000 |

$180,000 |

To qualify for the AOTC, the student must

- Be pursuing a degree or another educational credential recognized by the IRS.

- Be a full-time student enrolled for any part of five months of the year.

The student does not qualify for the AOTC if they

- Have completed the first four years of higher education at the beginning of the tax year.

- Have claimed the AOTC, or the former Hope Credit, for at least four tax years.

- Have a felony drug conviction by the end of the tax year.

Lifetime Learning Credit

The LLC reduces income tax bills for students and families covering education expenses, like tuition. Unlike the AOTC, the LLC is not limited to undergraduate expenses. Plus, there’s no cap on the number of years it can be claimed, making it a versatile option for continuous learners.

The LLC allows you to claim 20% of the first $10,000 you spent on qualified education expenses and provides up to $2,000 per tax return.

It's important to note that the LLC is a nonrefundable credit. That means that it can reduce your income tax bill to $0, but it won't result in a refund beyond that.

The amount of your LLC is subject to income limits. For 2024, the LLC will be phased out if your MAGI is between $80,000 and $90,000 ($160,000 and $180,000 for joint filers). If your MAGI is more than $90,000 for single filers or $180,00 for joint filers, you cannot claim the LLC.

|

If you are... |

LLC starts phasing out at a MAGI of... |

LLC completely phases out at a MAGI of... |

|

Single |

$80,000 |

$160,000 |

|

Married filing jointly |

$90,000 |

$180,000 |

Note: The MAGI limits for credit phase-outs are the same for both education credits.

To qualify for the LLC, you must meet the following criteria

- You, your dependent, or a third party must pay qualified education expenses related to higher education.

- The student must be enrolled at an eligible educational institution.

- The student must be taking courses aimed at gaining or improving job skills, or they must be pursuing a degree or a different recognized educational credential.

- The student must be enrolled for at least one academic period that begins within the tax year.

IRS Form 8863 qualified expenses

IRS Form 8863 supports claims for the AOTC and the LLC, which both cover some overlapping expenses directly linked to enrollment and attendance at an eligible educational institution. These include tuition and mandatory fees necessary for enrolling or attending, such as lab or technology fees.

Additional eligible expenses for AOTC

The AOTC covers some additional qualified expenses, including books, supplies, and equipment needed, even if these items are not purchased directly from the school. For example, if you need to buy a textbook from an online retailer or a local bookstore, this cost can be included in your AOTC claim.

Additional eligible expenses for the LLC

The LLC covers some additional qualified expenses, including books, supplies, and equipment needed, only if these items are purchased directly from the educational institution. For example, if you need to buy a textbook from an online retailer or a local bookstore, this cost can’t be included in your LLC claim. However, if you purchase the books from the school’s bookstore, you can claim the cost in your credit.

Expenses not covered

Certain costs are not covered by either credit. These include room and board, insurance, medical expenses, transportation, and other personal, living, or family expenses. Also, expenses related to sports, games, hobbies, or non-credit courses do not qualify unless they are part of the degree program or, for the LLC, help the student improve job skills.

Remember, to claim these AOTC expenses, they must be for education that leads to a degree or a recognized educational credential. This is limited to the first four years of post-secondary education and requires that the student be enrolled full-time for at least five months out of the year.

How to calculate Form 8863 expenses

Here's a quick guide to calculating education credits on Form 8863.

- Identify eligible expenses - The AOTC covers tuition, required fees, and necessary course materials, regardless of where they're purchased. The LLC covers tuition and mandatory fees required for enrollment at an eligible institution, as well books and supplies that are required and purchased through the school.

- Calculate adjusted expenses - Use the total of your educational expenses and subtract any tax-free aid, like scholarships or refunds, to find your adjusted qualified education expenses.

- Note expense limits - For the AOTC, do not exceed $4,000 in eligible expenses per student. For the LLC, do not exceed $10,000 in eligible expenses per tax return.

Who can claim an education credit?

The answer involves understanding a few key eligibility requirements.

Here are the general rules

- The credit must be claimed by the person responsible for the education expenses. This can be the student themselves, a parent or guardian, or another individual if they are not a dependent of another taxpayer.

- The student must be you, your spouse, or a dependent listed on your tax return.

- The student must be enrolled at an eligible educational institution. This includes most accredited public, nonprofit, and privately owned for-profit postsecondary institutions.

- Both credits have the same income limits that may phase out or eliminate the credit based on your MAGI. The limits may vary by tax year.

- You can’t claim both the AOTC and the LLC for a single student in one year. Each student may use one of the credits per year.

Form 8863 instructions

Whether you’re claiming the AOTC, the LLC, or both, it’s important to ensure you fill out Form 8863 correctly. For a detailed explanation, check out these Form 8863 instructions from the IRS. Before you get started, make sure that you have Form 1098-T, which should have been sent out to you from your school. This form provides information about your educational expenses, and it can help you determine if you qualify for tax credits and deductions.

You’ll also need to make sure that you have your W-2s, any 1099s, receipts, and other documentation for your qualified educational expenses, and your school’s information, including its employer identification number (EIN).

Navigating the complexities of educational tax credits with IRS Form 8863 can be challenging, and tax rules can be intricate and are subject to change. Don't navigate the process alone. Work with a Jackson Hewitt Tax Pro who can help you get it right.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 60+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.