Worker status is not a new tax issue, but it is becoming more and more relevant as many workers enter the gig economy. Workers with side hustles are often treated as independent contractors/self-employed, and these workers are often surprised when they file their taxes and owe a significant balance to the IRS.

Employee vs Independent Contractos: Tax impact

For workers treated as independent contractors, the tax implications can be significant. For example, independent contractors are responsible for their own Social Security and Medicare taxes. They must pay self-employment taxes (Social Security and Medicare taxes) at the rate of 15.3% on top of their normal income taxes. For many, this is a significant bill come tax time. For example, if a taxpayer made $20,000 as an independent contractor and was in the 28% tax bracket, the additional tax would be $8,660 (28% income tax or $5,600, plus 15.3% self-employment tax or $3,060).

Independent contractors are often surprised at the end of the year because they have “no taxes taken out of their pay.” Independent contractors must pay their own taxes throughout the year with quarterly estimated tax payments to make sure that they have paid in enough each quarter to avoid an estimated tax penalty. Independent contractors also have more complicated tax returns because they must account for and report their income and allowable expenses to the IRS as a small business owner.

Determining whether you should get 1099 or a W-2

The determination of whether a worker is an employee or self-employed depends on who has control: the company or the worker. In many cases, this is not an easy determination.

The general rule is that an individual is a self-employed if the payer company has the right to control or direct only the result of the work, not what will be done and how it will be done. The IRS provides three control factors to help make this determination:

- Behavioral control: whether the worker has the right to control the how, when, and where the work is performed. If the worker is trained and given instructions on how to do the job, then they are more like an employee than an independent contractor. Self-employed taxpayers generally are given a result to produce and are not instructed on how to produce the result.

- Financial control: whether the worker can direct or control the financial and business aspects of the job. Factors in favor of employee status include: no significant investment by the worker, inability to make a profit or loss (i.e. paid by the hour with no expenses), work only for the one company, and payment method (weekly, hourly). Independent contractors generally can work for multiple companies and can make a profit or loss on the job performed. They are also more likely to incur their own expenses to perform the job.

- Relationship of the parties: workers that have permanent relationships, provide services that are a key activity of a business, receive benefits, and have contract terms similar to an employee (like paid leave) are generally employees. Workers with results-related contracts that are not integrated into the business are more like indepedent contractors.

Making the worker status determination

Each worker relationship requires a legal determination of the worker’s status when the worker is hired. If the worker has more control, the or she is an independent contractor, receives or 1099-NEC (for nonemployee compensation), and is responsible for his or her own tax payments. If the company has more control, the worker is an employee, receives Form W-2 (employee income), and the employer is responsible for withholding the employee’s taxes and paying ½ of his or her social security and Medicare taxes.

Businesses with employees often have other obligations including providing health insurance, retirement packages, and other benefits provided to other employees of the company. An incorrect determination can lead to a costly tax bill and serious scrutiny from the IRS, the Department of Labor, and state agencies like unemployment and worker’s compensation departments.

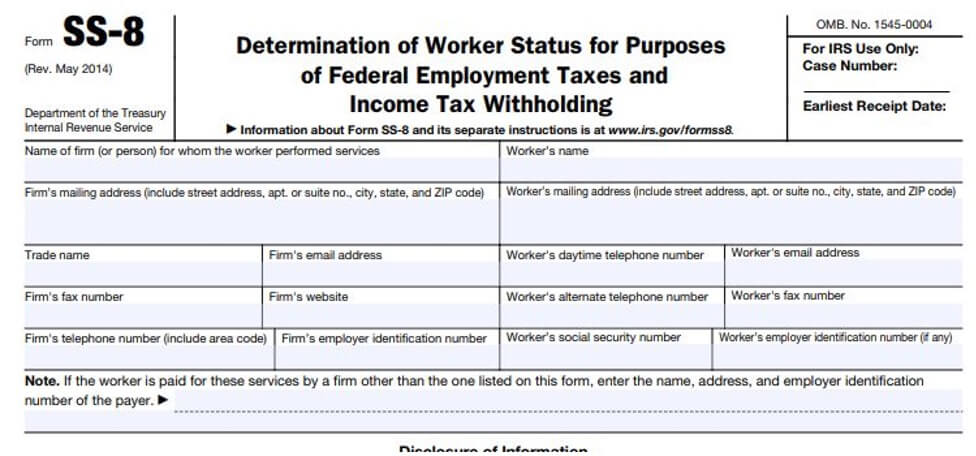

Contesting worker status: Form SS-8

Workers who believe they are incorrectly categorized as independent contractors can contest the determination. Many workers are reluctant to contest their status for fear of being fired by the company. If a worker wants to contest this or her status, the IRS provides Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, to help them do so.