- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: W-4V

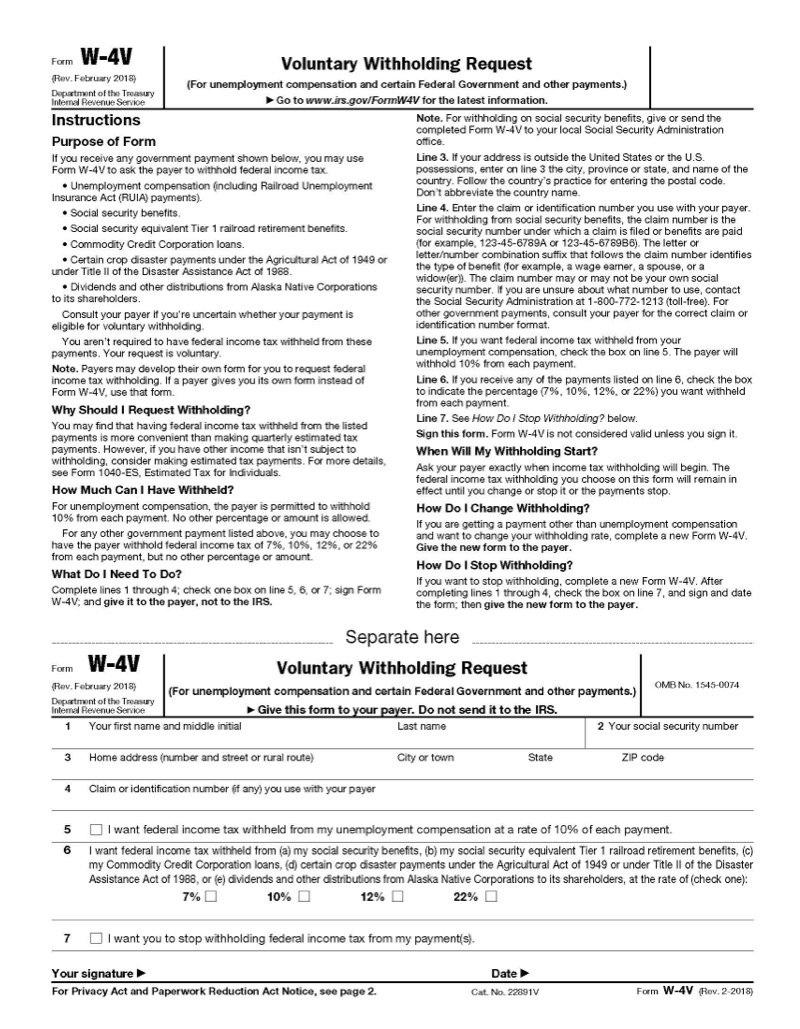

How to Request Voluntary Withholding of Non-Wage Income with Form W-4V

What is IRS Form W-4V? Learn the basics of Form W-4V and requesting voluntary withholding of non-wage income.

What is Form W-4V?

Form W-4V is the form used to voluntarily request federal income tax withholding on government paid income such as Social Security benefits or unemployment compensation. Similarly to its W-4 counterpart which adjusts tax withholding on wages and salaries based on a table, Form W-4V is designed to arrange automatic withholding on different types of non-wage income.

Unlike wages and salaries, withholding is based on a prescribed percentage and no other percentages or amounts can be requested. Withholding is also entirely voluntary. While you still must report the taxable portions of these payments on your tax returns as necessary, you are not actually mandated to have federal income tax withheld as you are with employment income.

What types of income can get taxes withheld with Form W-4V?

The income sources connected to Form W-4V are primarily governmental. They include the following:

- Unemployment benefits

- Social Security benefits

- Railroad Retirement benefits

- Alaska Native Corporation dividends and other distributions

- Crop disaster payments

- Commodity Credit Corporation loan proceeds

Unemployment benefits are subject to a flat 10% federal income tax withholding rate regardless of which state you receive benefits from, and any other sources of income that you have.

The other types of income on this list can have 7%, 10%, 12%, or 22% in federal income tax withheld from each payment you receive.

Am I required to fill out Form W-4V?

Some government benefit payments may be wholly or partially nontaxable, such as Social Security income. The types of income listed on Form W-4V do not actually mandate that taxes must be automatically withheld from these payments, as they are with employment income.

When you begin receiving benefits, the payer may direct you to Form W-4V or provide their own equivalent form. If you have concerns about the tax impacts your benefits could have on your tax return, you should consult the government agency issuing the payments and determine if the benefits are eligible for voluntary withholding.

Many taxpayers opt to voluntarily withhold income taxes from their benefits to avoid potential underpayment penalties and shortfalls at tax filing time, especially for benefits that are typically fully taxable like unemployment. If your non-wage income is otherwise taxable but not eligible for voluntary withholding, you may need to file Form 1040-ES or use the IRS online payment systems to make quarterly estimated tax payments.

If you would like to cease federal income tax withholding on your government benefits, you can also submit a new Form W-4V to the payer with the box in Line 7 checked off.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.