- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

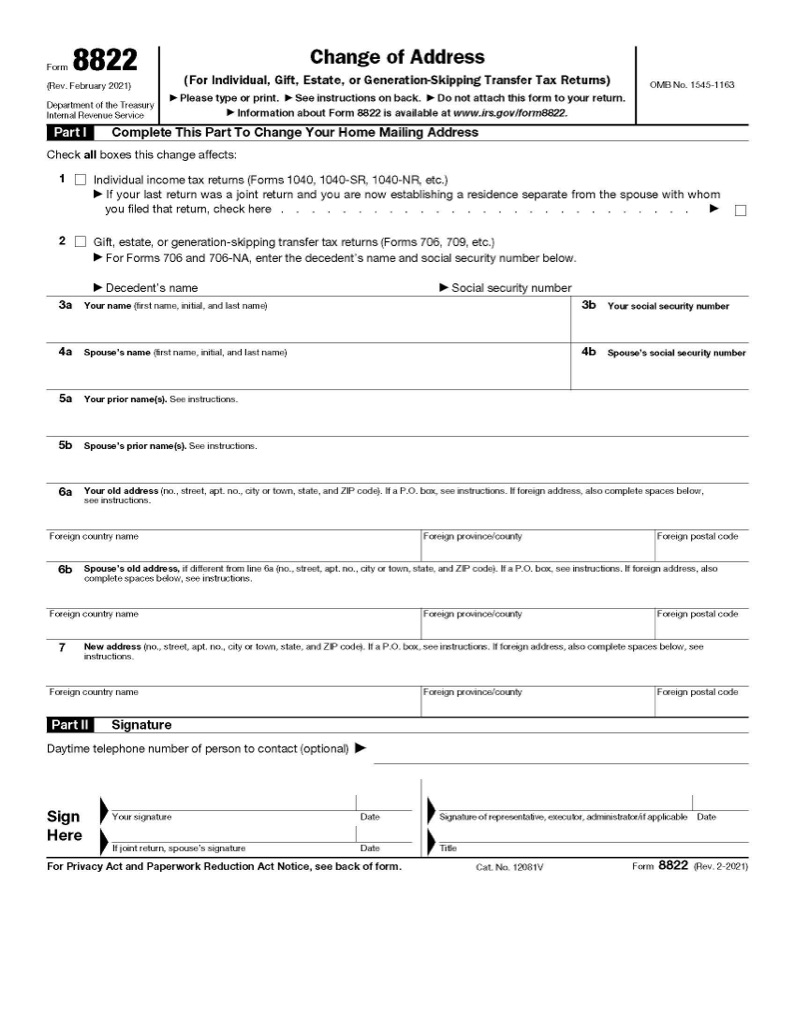

IRS FORMS: FORM 8822

Filing a Change of Address with the IRS Using Form 8822

Have you recently moved and need to change your address with the IRS? Fill out a Form 8822. Read on to find out how.

What is the purpose of Form 8822?

Form 8822 is used to report changes to your home address to the IRS when you’ve moved.

If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use Form 8822 to update the mailing address the IRS has on file, which will need to include a copy of your power of attorney. However, if you are changing the location of your business and need to update the business address, you will need to use Form 8822-B.

All address change requests take approximately 4-6 weeks to process.

If I filed a change of address with the Post Office, do I still need to use Form 8822?

Yes, you should update your address with the IRS by filing Form 8822. If you moved or have otherwise changed your address, filing Form 8822 will ensure the IRS has the correct address to send communications and payments due to. The IRS is not able to update an address from the USPS change of address process and is not required to find your new address if you change it.

Most people will file a change of address with the post office when they relocate so their mail can be forwarded with minimal disruptions. If you update your address with the US post office, it does not automatically inform the IRS, or any other government agencies. Additionally, some post offices may not forward tax refund checks due to fraud concerns.

The IRS considers mailing any notices or letters to the last address on file as a completed transaction. So, a taxpayer who owes the IRS money due to errors, non-filing, or non-payment of tax returns can find themselves subject to a lien or levy because they didn’t receive relevant IRS notices. It is always in your advantage to update your address with the IRS.

Additionally, Form 8822 should be filed for every member of your household, including children, who file their own income tax returns.

Is changing my address on my next tax return sufficient to report an address change?

If you are not expecting any communications concerning tax bills and payment plans, and are not expecting a tax refund check, using your new address on your tax return is all you need to do to update your address with the IRS.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.