- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

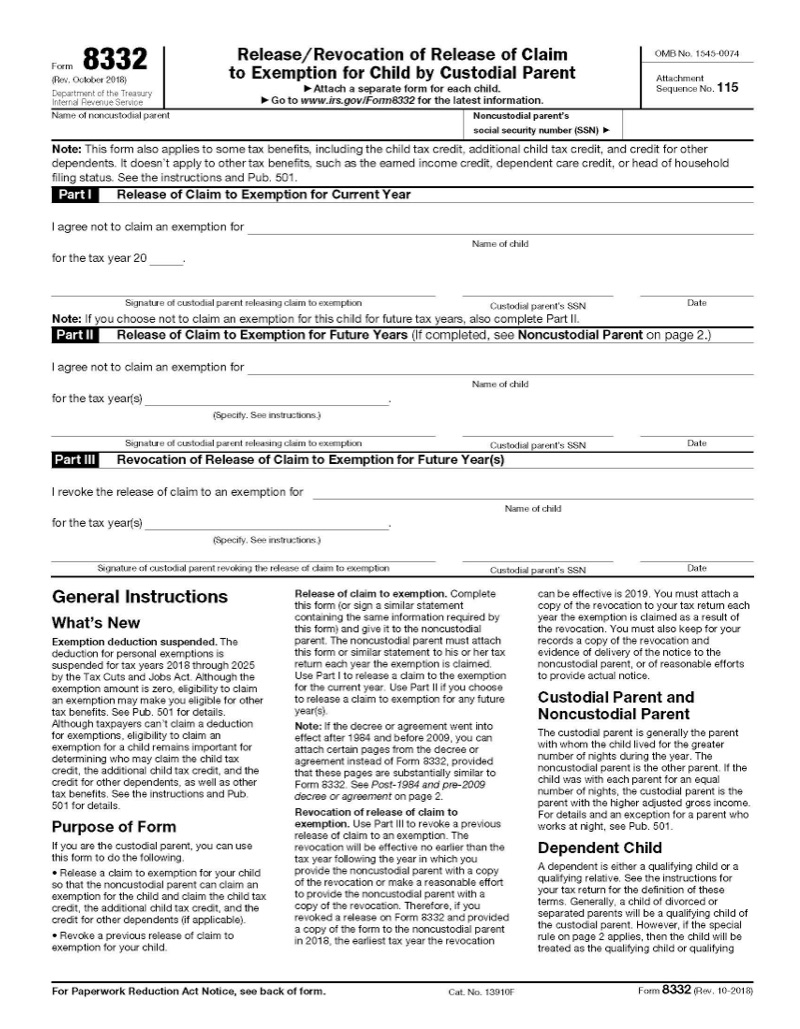

IRS FORMS: FORM 8332

Using Form 8332 to Release Your Child's Dependent Exemption to Noncustodial Parent

What is IRS Form 8332? Learn the basics of Form 8332 and releasing a child’s dependent exemption to a noncustodial parent.

What is Form 8332 used for?

Form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. Permission can also be granted for future tax years so you do not need to repeatedly file this form. This can be done by writing “all future years” in Part II.

However, separate Forms 8332 will be required for each child. The child and noncustodial parent need to be named on each form.

Form 8332 is used when a divorce or separate maintenance agreement specifies a noncustodial parent can claim the dependent children. Use it when you are separated from the noncustodial parent to allow them to claim the child's exemption.

Is Form 8332 still usable after the 2018 Tax Reform?

The 2018 tax reform eliminated personal and dependent exemptions. Form 8332 is still used to allow the noncustodial parent to claim a dependent child for purposes of the child tax credits.

You may need the form for your state income taxes or to release a related tax benefit to the non-custodial parent.

Will I forfeit other parental tax benefits if I file Form 8332?

Generally, the custodial parent receives more tax benefits than the noncustodial because the child is their dependent. Most parental tax benefits require that the child lives with you more than half the year, and/or that both parents provide more than half of the child’s total support.

If you file Form 8332, a majority of the tax benefits you receive as the custodial parent will not be affected. The earned income tax credit, child and dependent care credit, and head of household filing status are unaffected by waiving your child’s dependency exemption. As the custodial parent, you are still entitled to these benefits as long as you meet the other rules surrounding the tax benefits.

However, if you file Form 8332, the noncustodial parent will receive the allowable amounts of child tax credit and additional child tax credit.

Is Form 8332 required if my divorce decree has a tax provision?

The IRS may allow you to waive filing Form 8332 if your divorce was effective after 1984 but before 2009 and the noncustodial parent attaches the relevant pages from the divorce decree to their tax return. The decree must outline all of the following:

- That the noncustodial parent may claim the named child or children as a dependent regardless of other conditions met (e.g. visitations and child support)

- The custodial parent will not claim the child or children as dependents

- Specific years in which the custodial parent waives the child's dependency exemption

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.