- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 8283

Reporting Noncash Charitable Contributions on Form 8283

What is IRS Form 8283? Learn the basics of Form 8283 and reporting additional taxes on tax advantaged accounts.

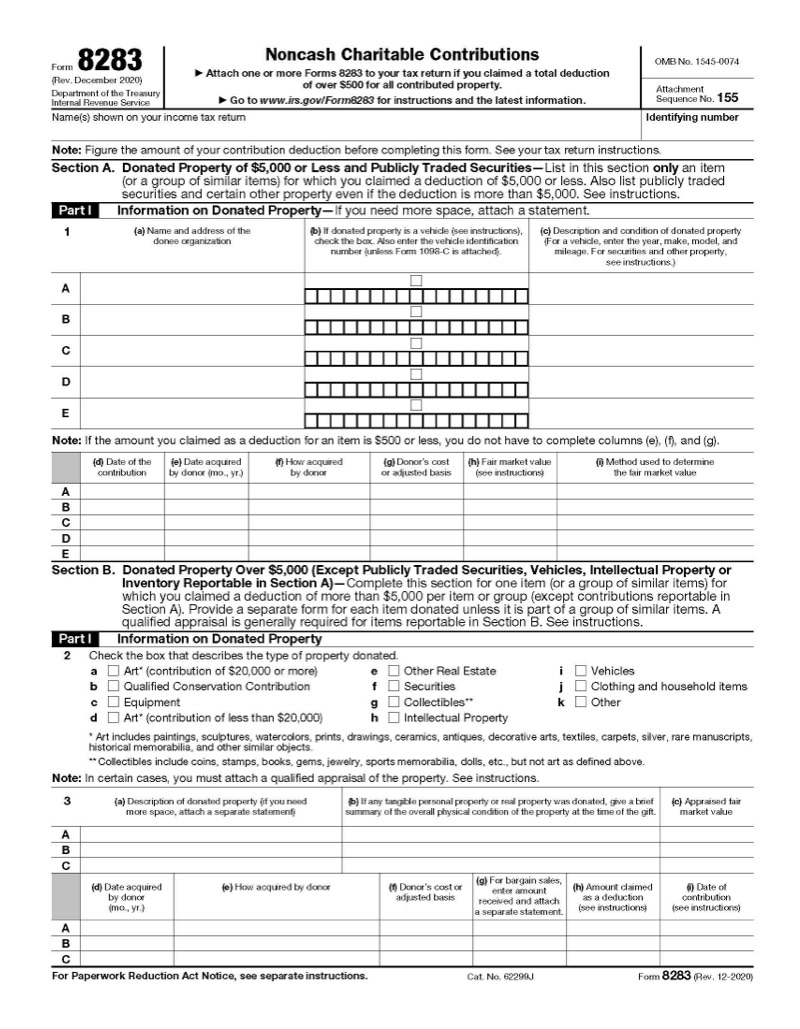

What is Form 8283 used for?

Form 8283 is used to report noncash donations exceeding $500. If you are claiming a charitable contribution deduction and have a significant amount of noncash donations, you may be required to file Form 8283 as well as the Schedule A.

Donations made by check, credit or debit card, or cash do not need to be reported on Form 8283. If you have personal expenses for volunteer work, these expenses are reportedly similarly to cash donations. Form 8283 is only used for the donation of goods, securities, vehicles, real estate, and other noncash assets to qualified organizations.

Do I need to file multiple copies of Form 8283 if I made several donations?

If you made several cash donations, you only need to aggregate them and report them on Schedule A. However, noncash donations that exceed $500 total or that require an appraisal require Form 8283.

For example, you are moving and donating a significant amount of personal property. You estimate that you have donated $750 worth of clothing and household items in multiple trips to Goodwill, and you also donated your car to charity with a blue book value of $2,000. You would need to file one Form 8283 and include the Goodwill donations, and the vehicle donation.

Both go in Part I of the form since their fair market value is less than $5,000. For vehicle donations that exceed $500, there must be written acknowledgement from the donee, which is typically reported on Form 1098-C with Copy B furnished to the donor.

The name of the charity and description of donated property must be included. If each individual trip to Goodwill was valued at less than $500, additional information on how much you paid, how you acquired these items, and fair market value does not need to be supplied on Form 8283.

Am I required to get an appraisal if I file Form 8283?

If your noncash donation is valued at less than $5,000, an appraisal is generally not required. However, if the value is $5,000 or greater, a qualified appraiser must fill out Part IV. In some cases, the donee must also fill out Part V which acknowledges their receipt of the property. This is more common with high-value donations such as art and real estate.

Even if your noncash donation is less than $5,000, you are required to have written substantiation from the charity for any noncash donations exceeding $250. For clothing and household items in particular, they must be in good condition and several charities will have valuation guides for items that are commonly donated.

If a single donation or aggregate number of donations throughout the year is estimated to exceed $500, you should keep an inventory of these items as well as pictures in the event your donation record is examined. A qualified appraisal is recommended for donated household items exceeding $500 regardless of condition, if you plan to donate several items.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.