- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

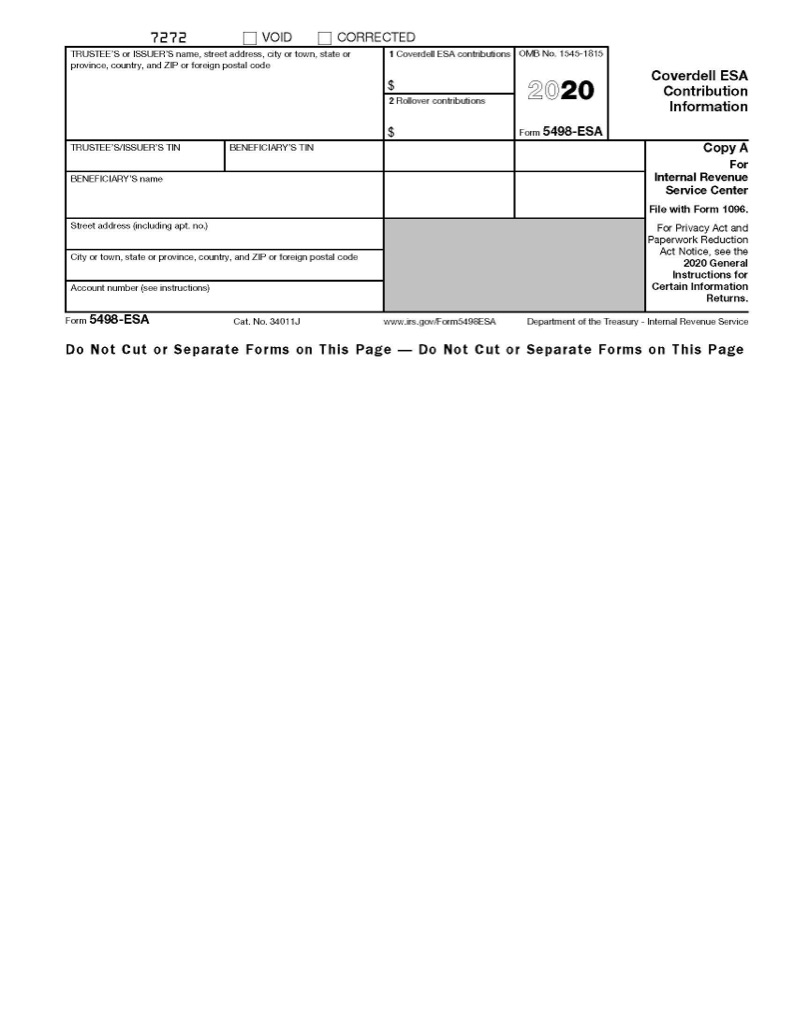

IRS FORMS: 5498-ESA

Understanding Coverdell ESA Distributions and Form 5498-ESA

A Coverdell ESA is a higher education savings account that takes the form of a trust or custodial account originated in the United States, designed solely for paying the beneficiary's qualified education expenses in the future. When the account is created, it must be declared a Coverdell ESA for federal tax purposes.

What is Form 5498-ESA?

ESAs can be established for any child beneficiary under the age of 18, but the contents of the account must be fully withdrawn by the time the beneficiary reaches age 30 (with the exception of disabled beneficiaries).

Form 5498-ESA is furnished to the account owner when contributions are made to a Coverdell ESA. When distributions are made, they are reported on Form 1099-Q.

When would I receive Form 5498-ESA?

If you made any contributions to a Coverdell ESA in the past year, one copy of Form 5498-ESA is issued to the beneficiary and another to the trustee.

Typically, the trustee is a parent or guardian and the beneficiary is their child, although another beneficiary can be appointed provided that they are under 18. The beneficiary and trustee do not need to be related, but it is common to keep Coverdell ESAs within a family since funds may be transferred to any other family member under the age of 30 without penalty.

This type of rollover would be reported in Box 2 of Form 5498-ESA.

Are Coverdell ESA contributions tax-deductible?

Contributions to Coverdell ESAs are not tax-deductible at the federal level, however, their primary purpose is to provide tax-free distributions when the beneficiary needs to withdraw them to pay for educational expenses.

Individual trustees are limited by their modified adjusted gross income (MAGI) with respect to the contributions they may make to the account, which is $110,000 for 2020 ($220,000 if married filing jointly). In addition to the trustee’s contributions, trusts and corporations can make unlimited contributions to the beneficiary’s Coverdell ESA as well.

While paying for college expenses is the most common and well-known purpose for a , Coverdell ESA, distributions can also be used to pay for certain elementary and secondary education expenses.

Recordkeeping for Coverdell ESA contributions

It is important to keep track of Coverdell ESA contributions and distributions, especially if the beneficiary has a large family, participates in scholarship contests, and other situations where multiple contributions within the same year are likely.

Regardless of the trustee’s relationship to the beneficiary, the total contributions for all of the beneficiary's Coverdell ESAs cannot exceed $2,000 per year. If the sum of contributions for the year exceed this amount, the excess must be withdrawn along with any earnings, by June 1, of the following year or they may be subject to a penalty.

In addition to avoiding this penalty on excess contributions, accurate recordkeeping for Coverdell ESA distributions and contributions helps prevent “double dipping” if multiple education savings tools and tax benefits are being utilized.

For example, the American Opportunity Credit, Lifetime Learning Credit, and 529 plan distributions may cause confusion with which expenses are a qualified education expense for the year if Coverdell ESA distributions are also used to pay for these expenses.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.