- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 5329

Reporting Additional Taxes on IRAs and Other Tax-Advantaged Accounts on Form 5329

What is IRS Form 5329? Learn the basics of Form 5329 and reporting additional taxes on tax-advantaged accounts.

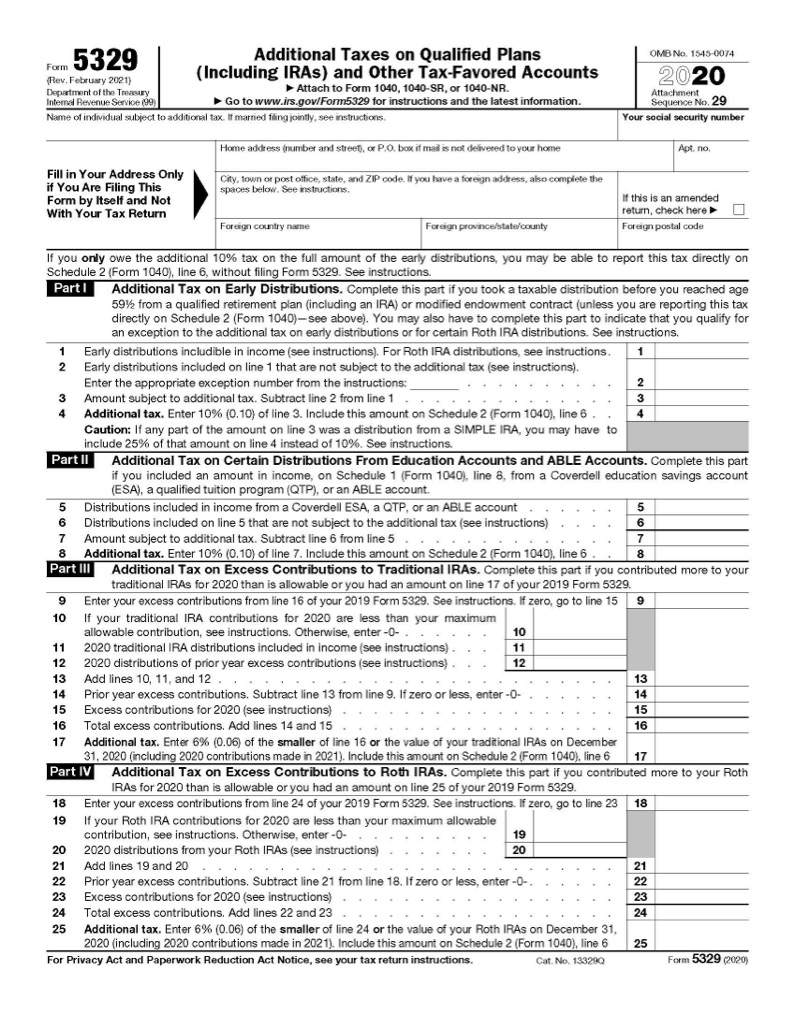

What is Form 5329 Used For?

Form 5329 is used to report a variety of transactions related to tax-favored accounts such as IRAs, 401(k) plans, educational saving accounts and others.

The most common purpose for this form is to calculate the 10% additional tax, and any exception to the tax, on early withdrawals from these accounts if you are under age 59 1/2. However, it is also used to report excess contributions to certain accounts as there are tax consequences for these transactions.

Am I required to file Form 5329 if I took money out of my IRA or 401(k)?

Form 5329 is not always required to be when you withdraw money from your IRA or retirement account. If you are over the age of 59 ½ and received a distribution from a retirement plan like an IRA or 401(k), there is no 10% additional tax although you may owe income tax on some or all of the distribution.

There are also cases where you may need to file Form 5329 in order to report the distribution but may not actually owe a penalty and/or additional taxes. This occurs when the taxpayer qualifies for an exception to the 10% additional tax. The most common reason for this is using up to $10,000 from your IRA to buy a house for yourself or a family member. Certain coronavirus-related early distributions are also not subject to the 10% additional tax, and do not need to have Form 5329 filed.

Many exceptions also only apply to IRA owners rather than qualified plans in general. Early IRA distributions can also be used to pay for health insurance while you are unemployed and higher education expenses without penalty. However, if you have any other type of qualified plan, the exception does not apply.

In addition to early withdrawals from retirement assets, Form 5329 is also used to report distributions from education savings accounts and ABLE accounts for disabled people. If these distributions were not used for their intended purposes, primarily the beneficiary's higher education and disability-related expenses respectively, some or all of the distributions received may be included in income, taxable, and subject to a 10% penalty.

What are excess contributions?

Distributions are not the only transactions with these accounts that can have tax consequences. If contributions are made in excess of the limit for that particular type of account and the taxpayer's circumstances, it can also create additional taxes.

This situation is most likely to arise from unexpected increases in income. Excess contributions can also be made by mistake, such as automated savings plans not realizing that the contribution limit for the year was reached and continuing to debit the taxpayer's account.

Parts III and IV on Form 5329 are used to report excessive contributions to traditional and Roth IRAs respectively. Page 2 of the form also covers excessive contributions to the following plans:

- Coverdell ESAs

- Archer MSAs

- Health savings accounts

- ABLE savings plans for disabled persons

Generally, the surtax on excessive contributions to these plans is 6% of the amount past the annual contribution limit.

Part IX covers the 50% tax on excessive accumulation of assets if you have not begun required minimum distributions (RMDs) from qualified plans, including traditional IRAs.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.