- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS Forms: Form 4852

How to Use Form 4852 as a Substitute for Missing Forms W-2 and 1099-R

What is IRS Form 4852? Learn about Form 4852 and substituting missing W-2s and 1099-Rs here.

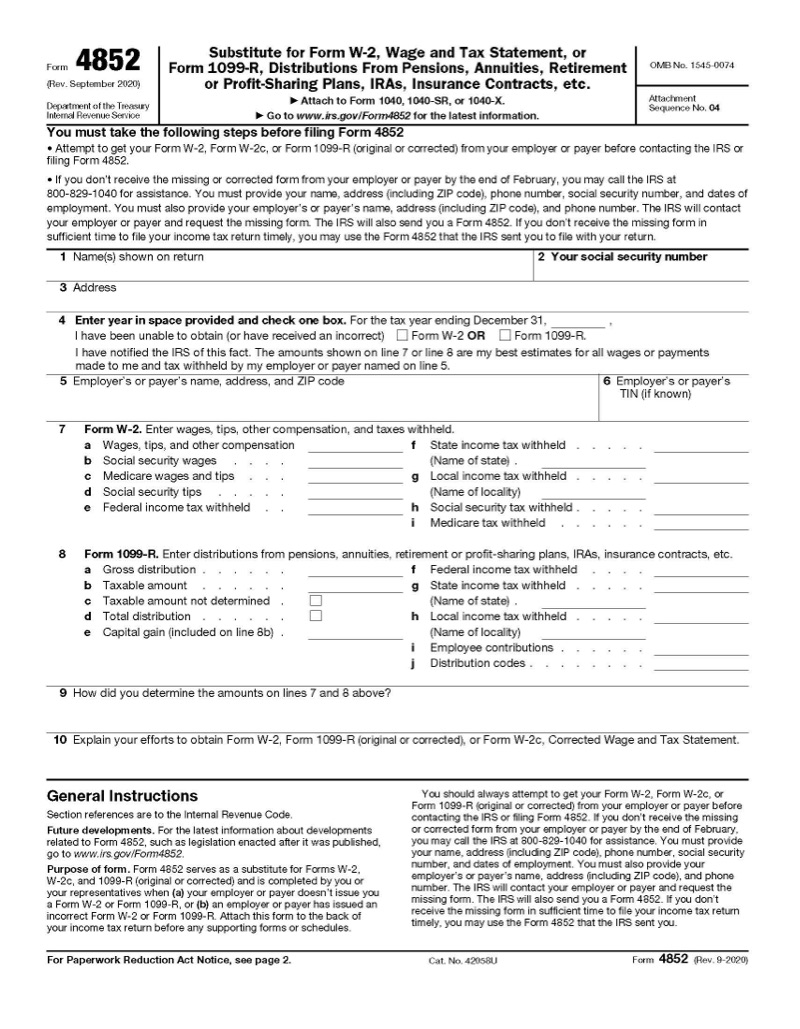

What is Form 4852, Substitute for Form W-2, Wage and tax Statement, or Form 1099R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRA’s Insurance Contracts, Etc., used for?

Form 4852 is used to report information about wage or retirement income when you do not receive a Form W-2 or Form 1099-R.

Generally, payers must furnish these forms to payees by January 31 of the following year. If you have not received a hard copy of your Form W-2 or 1099-R, or received these forms electronically by February 15, you should contact your employer or the company that administers your retirement income. If you are still unable to get the forms after contacting the company, reach out to the IRS. The IRS may tell you to file Form 4852.

If you received a Form W-2 or 1099-R that is incorrect, you do not need to complete and file Form 4852. You should contact the payer and ask them to correct your form and you should receive Form W-2C, or Form 1099-R with the box checked off at the top indicating that it is a corrected version.

Should I file Form 4852 with or before my tax return?

Form 4852 is filed with a tax return that is missing the required Forms W-2 and/or 1099-R. If you are filing Form 4852, you should keep it for your records as you may need to verify that your employer credited you for the earnings with the Social Security Administration.

If you need to contact the IRS, call 1-800-829-1040 and provide the agent with the following information:

- Name

- Address

- Social Security number

- Dates you were employed, or if retired, dates you began receiving distributions

- The employer or payer's name, address, and phone number

- Your employer or payer's tax ID, or any other identifiable information

When filing Form 4852, you are also required to document the efforts you made to get the Form W-2 or 1099-R that is missing, including whether you contacted the IRS and how often.

How do I fill out Form 4852 correctly?

After entering your name, address, and Social Security number on Lines 1-3, you need to specify on Line 4 whether you have a missing Form W-2 or 1099-R and to which tax year it pertains. The employer or payer's name is reported in Box 5, and their tax ID in Box 6 if you know it. If you don’t have the company’s tax ID, you will be unable to electronically file.

Lines 7a-7i are where substitute information for Form W-2 is added such as your gross pay, federal income tax withheld, Social Security and Medicare taxes withheld, and state income tax information. These figures can be found on the annual summary shown on some paystubs or aggregated from all of your paystubs. If need be, you can make a good faith estimate for these amounts.

Lines 8a-8j serve the same purpose for Form 1099-R, except distributions are reported. This information may be available on your pension statement or with each benefits payment. Similar to missing W-2s, this information can be approximated if an exact figure cannot be computed.

Line 9 describes how you approached these numbers, such as using paystubs or statements, or needing to estimate based off of deposits.

Line 10 is where you must describe your efforts to contact both the payer and the IRS to get the missing form.

Should I file Form 4852 with or before my tax return?

Form 4852 is filed with your tax return that is missing the required Forms W-2 and/or 1099-R. If you are filing a Form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the Social Security Administration. It may also be required to provide proof of income or employment verification.

In the event your employer or plan administrator issues the missing tax form, you may need to file an amended tax return on Form 1040X if there are differences between the amounts reported on Form 4852 and the missing Form W-2 or 1099-R.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.