- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 4562

How to Deduct Depreciation and Amortization on Form 4562

What is IRS Form 4562? Learn the basics of Form 4562 and deducting depreciation and amortization.

What is depreciation and amortization?

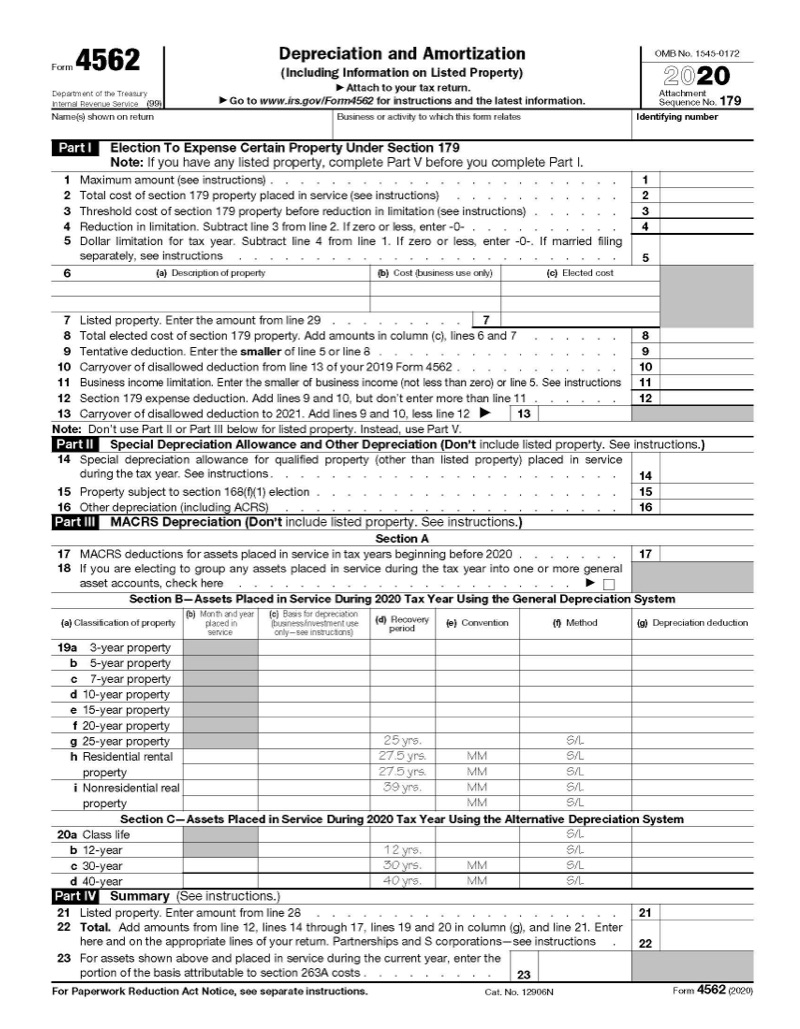

Depreciation is the only way IRS rules allow a business to deduct the cost of various assets used in the business. IRS Form 4562 is used to properly claim a deduction for assets used in your business or freelancing activities. Depreciation applies to assets that have a useful life of more than one year such as vehicles, computers, equipment, and more. Physical assets are subject to depreciation deductions, while intangible assets such as intellectual property and franchise fees are subject to amortization. When you’re starting a business, your startup costs prior to opening for business are also subject to amortization.

There are also some restrictions on listed property, which is property that can be used for both personal and business easily (such as computers). If you are depreciating an automobile, additional information on annual mileage and how many people have access to the vehicle must be provided on Page 2 of Form 4562.

Use the Form 4562 any year you have new assets placed in service. In many years, when you didn’t buy any new assets for your business, you will not use the form to report your deprecation. Instead, you will calculate the depreciation based on the appropriate table and report the amount directly on your schedule C, E, or F.

How do depreciation methods work?

First, the basis must be computed. The basis is the purchase price plus any applicable sales taxes, delivery fees, and setup charges. Repairs and maintenance over time do not add to basis, but improvements and upgrades do.

Next, a business percentage must be determined for the asset. This is especially important when you are dealing with items such as vehicles and computers. While you may have purchased machinery solely for your business and you have a business computer separate from your personal one, it’s less likely your car is used 100% for business. Apply the business percentage to the basis to determine the depreciable basis.

With the basis and business percentage determined, the asset is placed into the appropriate class. All assets have a specified class-life determined by the IRS. This class-life determines how long the asset is to be depreciated. If you are unsure of what the class-life of your asset is, check out IRS Publication 946: How to Depreciate Property.

Many small businesses will have property in the 5-year asset class, which covers vehicles and most equipment. The 7-year asset class covers furniture and fixtures while residential real estate has a 27.5-year recovery period. Nonresident real estate (including business use of your personal residence) has a 39-year recovery period.

The next step is to determine the recovery period, the date the asset is placed into service, the convention for the asset class which is typically based on the placed in-service date (typically mid-year), and the method. The deduction is calculated by applying the percentage from the class-life table and the time of the year the asset was first used.

There are multiple types of depreciation based on class-life and other factors. The modified accelerated recovery system (MACRS) is the standard depreciation system and the double declining balance (DDB) is the most commonly used method as it offers a sizable upfront depreciation deduction.

Can I just deduct a new computer or equipment in full?

The chief benefit of depreciation is that the deduction is spread over multiple years, which can be beneficial if one year is more profitable than the next. However, every taxpayer has unique circumstances and may wish to deduct the full amount upfront. This is referred to as a Section 179 deduction, which has a limit of up to $1,040,000 in 2020.

It is often taken for assets when a business first starts or after a large purchase in a tax year. Section 179 can be applied to numerous other asset types as well, if the taxpayer believes they benefit more from deducting the basis in full in the current year instead of depreciating over the asset’s life.

However, there are limitations on taking Section 179 deductions. The excess deduction is carried over to the following tax year if the total Section 179 deduction exceeds net business income, as this deduction cannot create a loss. For example, if $50,000 in revenue is reported on Schedule C with $45,000 in other deductible expenses but the owner wants to deduct a $7,000 truck in full, the $2,000 excess deduction is carried forward to the next year.

Depreciating the truck can create a business loss. Regardless, both Section179 treatment and depreciation are reported on Form 4562 along with all of the relevant information about the asset.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.