- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

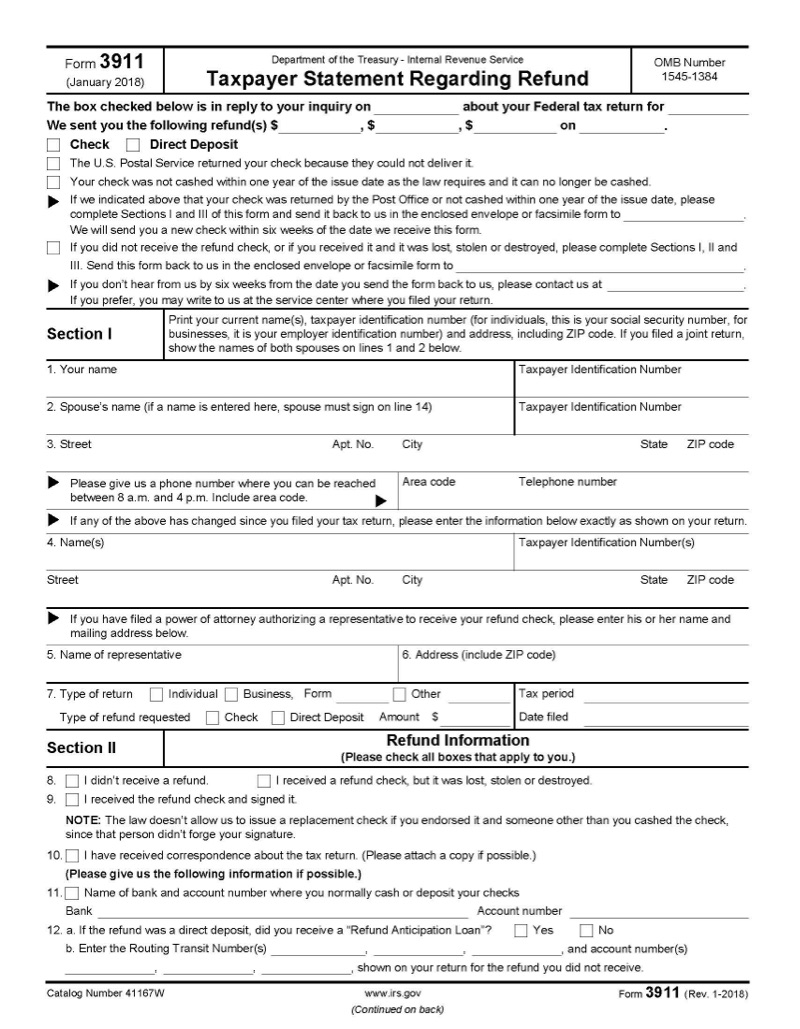

IRS Forms: Form 3911

Filing Form 3911 if You Never Received Your Tax Refund or Economic Impact Payment

If you filed your tax return, were entitled to a refund but it was never deposited into your account, you may have entered your bank details incorrectly on your tax return. If you moved and were expecting your refund by mail, the US Postal Service is likely to have returned it if a year had passed.

Even if a systemic error prevented your refund from reaching you and the check was otherwise not lost or destroyed to your knowledge, the IRS can help.

Regardless of the reason for never receiving your tax refund, filing Form 3911 with the IRS helps trace your refund to determine its whereabouts. While predominantly used for tax refunds, Form 3911 has also been utilized for missing economic impact payments that were issued pursuant to the CARES Act.

When should I file Form 3911?

The primary purpose of Form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. You should only file Form 3911 if a substantial amount of time has passed since you filed your tax return or your economic impact payment was considered sent to you by IRS.

You can track your federal tax refund online for free with the Where’s My Refund tool. The IRS advises that you should wait at least 24 hours after electronically filing your tax return before checking on your refund’s status, and at least four weeks if you filed a paper return.

If you are eligible for the Earned Income Tax Credit and/or Additional Child Tax Credit and you filed your tax return early, you can expect delays as these refunds are not processed until February 15 to verify eligibility. Taxpayers deemed eligible are expected to receive their refunds within one week of that determination.

If two weeks have passed since you electronically filed your return, or six weeks since you submitted a paper return, and you do not have any reasonable belief that your refund was lost or destroyed in transit, you should file Form 3911.

If you have good reason to believe your refund check was stolen or destroyed, you should report this to the IRS tracing line at 1-800-919-9835 and immediately file Form 3911.

For missing economic impact payments, the IRS recommends the following in filing a Form 3911:

- 5 days have passed since your direct deposit date on Notice 1444 or Get My Payment page

- 4 weeks have passed since your check was mailed

- 6 weeks have passed since the date it was mailed, but you moved and filed a forwarding address with the post office

- 9 weeks have passed since your check was mailed to a foreign address

Can Form 3911 be adjusted for economic stimulus payments?

Since Form 3911 was designed for tax refunds and not the economic impact payments, some modifications need to be made by you before submitting to the IRS.

"EIP" should be written at the top of the form, then all of the questions should be answered as they relate to your missing payment. "Individual" is the type of return in item 7, 2020 is the tax period, and "date filed" should be left blank. Form 3911 needs to be signed and must be signed by your spouse if you filed a joint tax return.

How soon can I expect a response from the IRS after filing Form 3911?

You can expect a response within 6-8 weeks of filing Form 3911. There may be delays because of limited staffing due to COVID-19.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.