- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

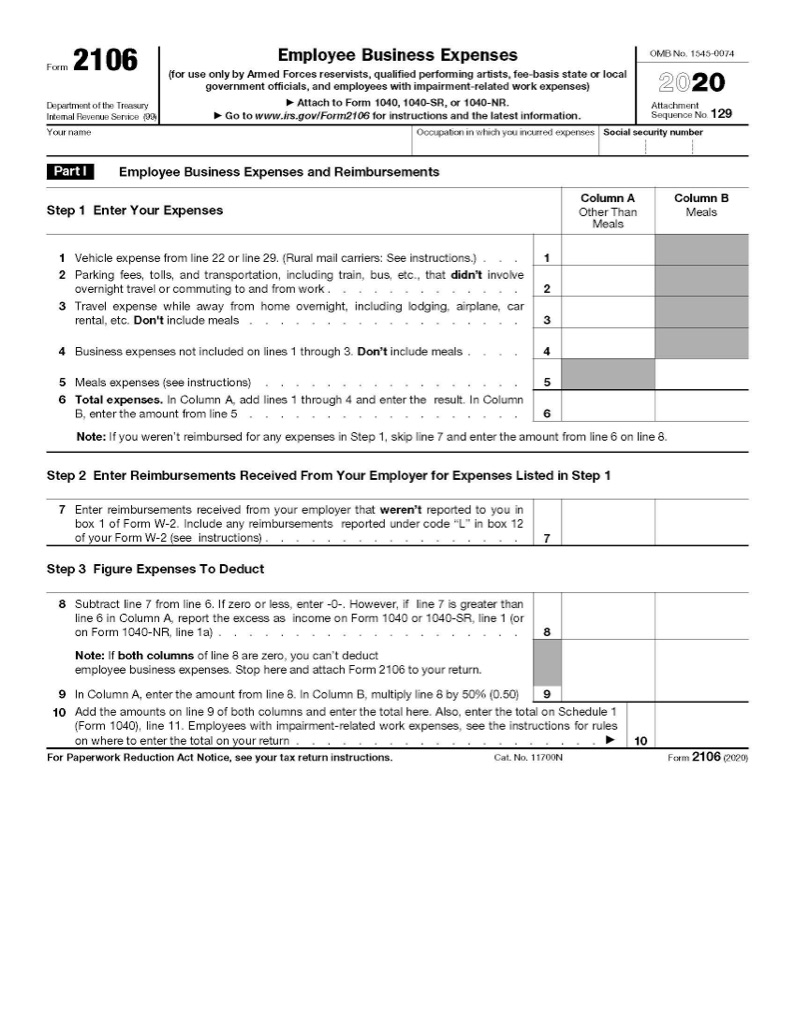

IRS FORMS: FORM 2106

Claiming Employee Business Expenses with Form 2106

What is IRS Tax Form 2106? Learn about Claiming Employee Business Expenses with Form 2106 here.

What is Form 2106?

Form 2106 is for employees who incur business expenses while performing their jobs, but do not receive any allowances or reimbursements from these employers.

Prior to 2018 tax reform, , the employee business expense deduction was a miscellaneous deduction for most taxpayers who are employees who itemized their deductions, where such amounts exceeded 2% of their of adjusted gross income (AGI). The 2018 tax reform suspended this deduction for most taxpayers until 2025. However, taxpayers employed in certain professions can still file Form 2106 to claim their business expenses and do not need to itemize to do so.

If you have open tax returns prior to 2019 that need to be filed, Form 2106 can still be used by taxpayers who itemized for those years.

What types of expenses can be deducted on Form 2106?

Form 2106 is the form used to claim allowed business expenses such as miles, meals, and other allowed expenses. Only certain taxpayers are currently allowed to claim business expenses including military reservists and qualified performing artists. Individuals who are in the military reserve units and are traveling more than 100 miles to report to their training can claim their mileage, tolls, parking, and overnight stay.

Individuals who are qualified performing artists, fee-basis state or local government officials and disabled individual who have impairment related work expenses are also eligible to claim their business-related expenses on Form 2106.

The following may qualify as deductible employee business expenses:

- Tools, supplies, and software

- Professional journals, media used in research, and other subscriptions, books, and publications

- Travel costs between work sites (not commuting from home to work, and back)

- Occupational clothing required for your job

- Conferences

- Special items for your employment such as a braille reader, a sign language interpreter, etc.

Most of these items are reported on Line 4 of Form 2016, except for vehicle expenses, parking and local travel, overnight travel, and meals expenses.

After any employer reimbursement has been subtracted from the total on Line 7, this amount is subtracted from the total expenses claimed in Part I. If the employer reimbursement exceeds the business expenses reported, this difference creates taxable income.

However, as discussed below, taxpayers in certain professions do not need to itemize to claim this benefit and can deduct the full business expense amount.

Which professions are allowed to file Form 2106 after the 2018 Tax Reform?

The following employees may file Form 2106, regardless of changes from the 2018 tax reform, and receive a full deduction for their business expenses without the need to itemize:

- Armed forces reservists

- Performing artists

- Fee-basis state and local government officials

- Disabled employees with accommodation or impairment-related work expenses

While fee-basis government officials are generally not common, symphony musicians and certain members of the armed forces who are not on combat duty are most likely to benefit from this deduction along with disabled workers who are paying impairment-related expenses out of pocket (such as screen readers and adaptive tools).

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.