- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 1099G

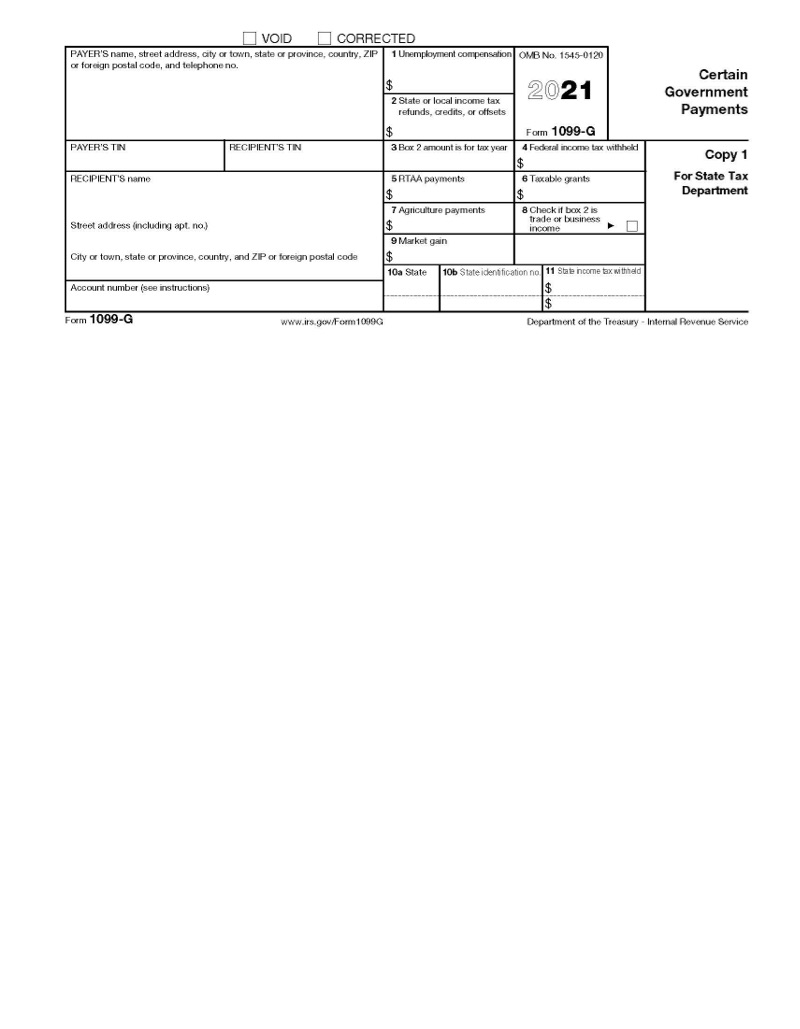

Understanding Your Form 1099-G, Certain Government Payments

If you received payments from the federal or state government, these will be reported on your Form 1099-G. Read on to learn more about this form.

What is reported on Form 1099-G?

If you received one or more payments from a federal or state government last year, these payments will be reported on Form 1099-G.

Unemployment benefits reported in Box 1 are the most common type of income that individual taxpayers are likely to encounter and see reported on Form 1099-G. However, there are other types of governmental payments that are reported on this form such as Department of Agriculture payments, certain taxable government grants, re-employment trade adjustment assistance (RTAA) benefits, and state and local tax refunds.

Certain government payments, such as public assistance programs, are not reported on Form 1099-G.

What is a state or local tax refund offset?

A state or local refund, credit, or offset may be reported on Form 1099-G even if you did not receive the amount shown.

This is likely to occur if you live in a state or locality with an income tax and your estimated tax payments or withholding were credited against a prior tax bill. If you made a charitable contribution to a state-sanctioned fund through your state tax return, you are also likely to see this contribution in Box 2 of Form 1099-G.

If the state accrued interest on your unclaimed refund, overpayment, or offset, the interest is likely to be reported in the blank box next to Box 9 if it was under $600. This item would need to be reported as interest income on your federal tax return.

How come my 1099-G doesn’t show any taxes withheld?

It is a common mistake to forget to have taxes withheld from your unemployment benefits, or other governmental payments. With the rise in unemployment claims and economic unrest in the wake of COVID-19, many taxpayers did not realize the income was taxable and that income tax could be withheld from their unemployment benefits.

Form W-4V is used to withhold federal income taxes from unemployment benefits and other types of income that permits voluntary withholding. For unemployment benefits, this voluntary withholding for federal income tax is 10% regardless of your other income and filing status. The total amount withheld for the year is reported in Box 4.

Conversely, Form W-4V can also be used to request that federal income tax withholding of your unemployment benefits is halted.

If you live in a state with an income tax and unemployment is wholly or partially taxable there, you may need a state equivalent of Form W-4V that must be submitted to your state’s labor department or unemployment bureau. The state tax withheld will be reported in Box 11.

If these boxes are blank, voluntary withholding forms were not completed at the federal and/or state levels before you received benefits. You may owe taxes on this income that you did not plan for, particularly if you were receiving Pandemic Unemployment Assistance payments and did not want to extend the wait to receive your benefits.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.