- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

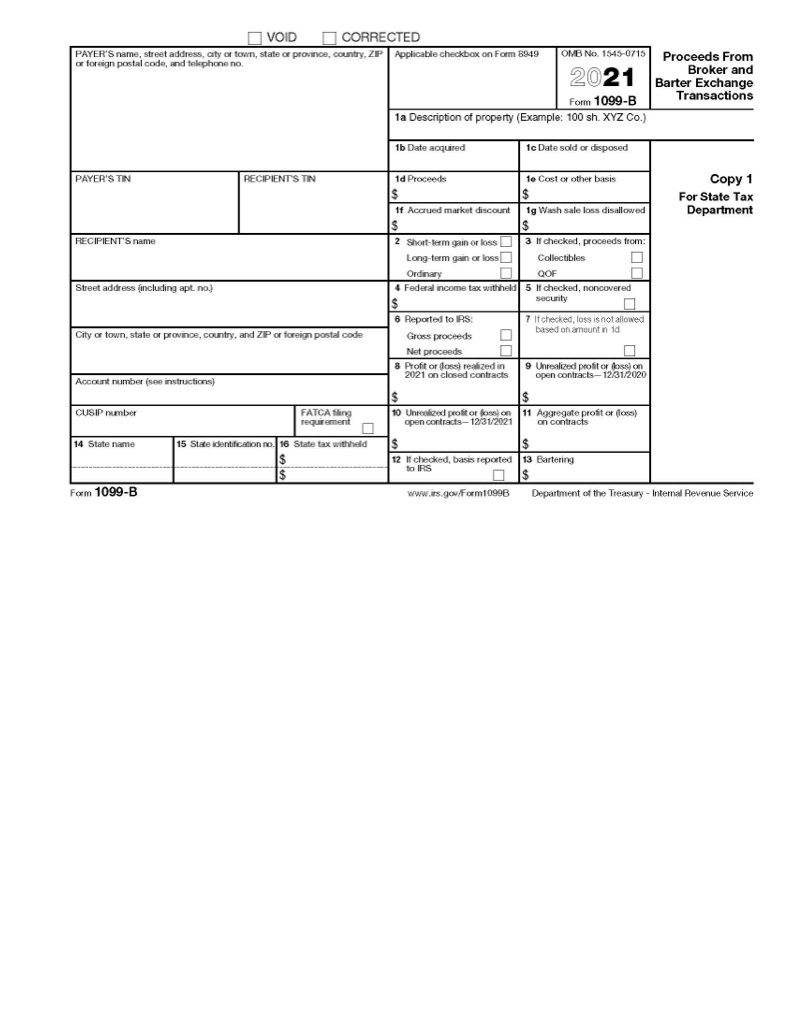

IRS FORMS: 1099B

Understanding Your Form 1099-B: Proceeds from Brokered and Bartered Transactions

What is IRS Form 1099-B? Learn about Form 1099-B and Proceeds from brokered and bartered transactions here.

What is Form 1099-B?

Form 1099-B is used to report property sales initiated and closed through a broker or other exchange system. For most taxpayers, Form 1099-B is used to report the sale of securities such as stocks, bonds, and mutual funds. However, it can also be used to report sales of collectibles, securities contracts, and bartering transactions.

The information on Form 1099-B is typically reported on Schedule D with Form 1040 to appropriately determine the taxable amount of capital gain income.

Understanding the boxes on Form 1099-B

Most taxpayers rely on Form 1099-B to report stock and other investment trades. Taxpayers who use large online brokers are most likely to find this information on a 1099 combination statement with Forms 1099-INT and 1099-DIV which summarizes all reportable investing activity within the same firm. If you have several stock sales with the same broker, information on each security sold tends to be provided on a page basis rather than individual Forms 1099-B for each trade. However, securities held with small brokers may result in one or more Forms 1099-B.

Box 1a describes the property sold. Appropriate abbreviations may be used such as "sh." for shares, the ticker symbol or fund name, and C, P, and O for common, preferred, or other class. Boxes 1b and 1c are the acquisition date and sale date respectively. It is important to note these dates since they determine if a short-term or long-term capital gain or loss has resulted from the trade (short-term was held less than one year while long-term is at least one year). Box 2 may or may not report whether the transaction was long or short term.

Box 1g refers to wash sales for certain short-term transactions. Wash sales must be reported in a certain way on Schedule D so ensure they aren’t netted with other capital gains and losses.

Box 1d reports the sales proceeds and Box 1e may report the cost basis. If it is blank, basis information was not readily available, and you may need to consult your own records for when you made the purchase and the original cost. If you have no cost basis for the assets sold, the basis is $0, and the sale price is all taxable income.

Box 2 has an option for "ordinary," which means that preferential capital gains reporting rules will not apply to the proceeds and it must instead be treated as ordinary income. It could still be considered investment income for earned income tax credit and net investment income tax purposes but would not be netted with other capital gains and losses.

Boxes 5 and 6 determine whether your transaction is covered and reported to the IRS or not.

What is covered vs. uncovered basis?

In 2008, brokerages became subject to mandates to report information about stock sales to the IRS. As a result, it is more common today to find covered transactions on Form 1099-B or combination 1099 statements from a broker. However, if you have been holding assets from before 2008 or the digital age entirely, the broker is likely to have your assets listed as having no basis on Form 1099-B.

The appropriate boxes are usually labeled for the appropriate transaction. If you did not receive a 1099 combination statement with Form 8949 attached, check the very top of Form 1099-B. Above Box 1a, there is a heading for "applicable checkbox on Form 8949" which should denote A, B, D, E, or X.

Codes A and B are for short-term transactions where A had basis reported to the IRS and B did not. Codes D and E have a similar function except they are for long-term transactions. Code X means the broker could not determine the holding period.

If you have uncovered transactions, you will need to examine your records to determine your cost basis and/or holding period to properly compute and report your capital gains and losses.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.