- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

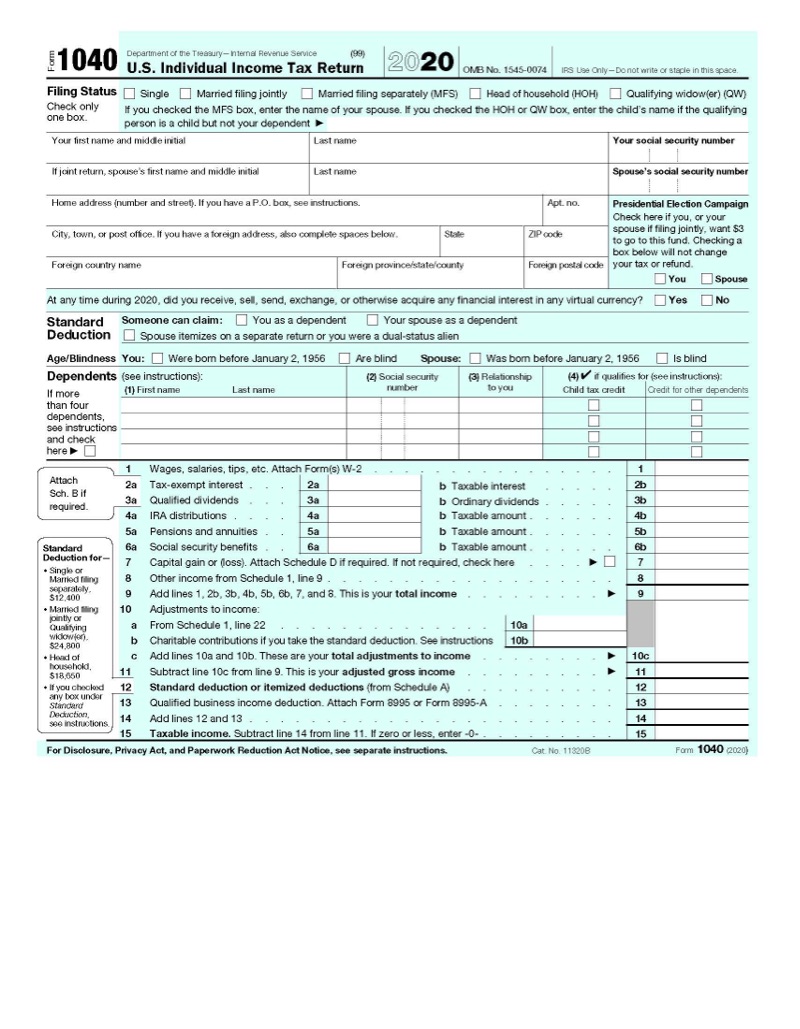

IRS FORMS: FORM 1040A

What You Need to Know About 1040A Tax Return Forms

What is IRS Form 1040A? Learn the purpose of Form 1040A and what forms to use now that this form is no longer available.

What is a 1040A Tax Form?

As of 2018, Forms 1040A and 1040EZ are no longer available although you can still use them to file prior year tax returns for 2017 back. With more than 90% of all individual tax returns electronically filed, the shift away from paper returns and numerous provisions of the 2018 tax reform caused the 1040A and 1040EZ tax forms to become redundant.

With more than 90% of all individual tax returns electronically filed, the shift away from paper returns and numerous provisions of the 2018 tax reform caused the 1040A and 1040EZ tax forms to become redundant.

Form 1040A and provisions of the Affordable Care Act

For taxpayers who receive health coverage through a Marketplace plan and received subsidies in 2017 and prior years, Form 1040A can be used to claim or reconcile the premium tax credit. If you received advance premium tax credit to pay for your premiums, you must file Form 1040A or Form 1040.

While the individual mandate was reduced to $0 in 2019, it was still in effect for 2017 and other prior years. Form 1040A can be used to report the shared responsibility payment if you did not meet minimum essential coverage requirements or have an exemption.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.