- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: 1099-MISC

All About Form 1099-MISC

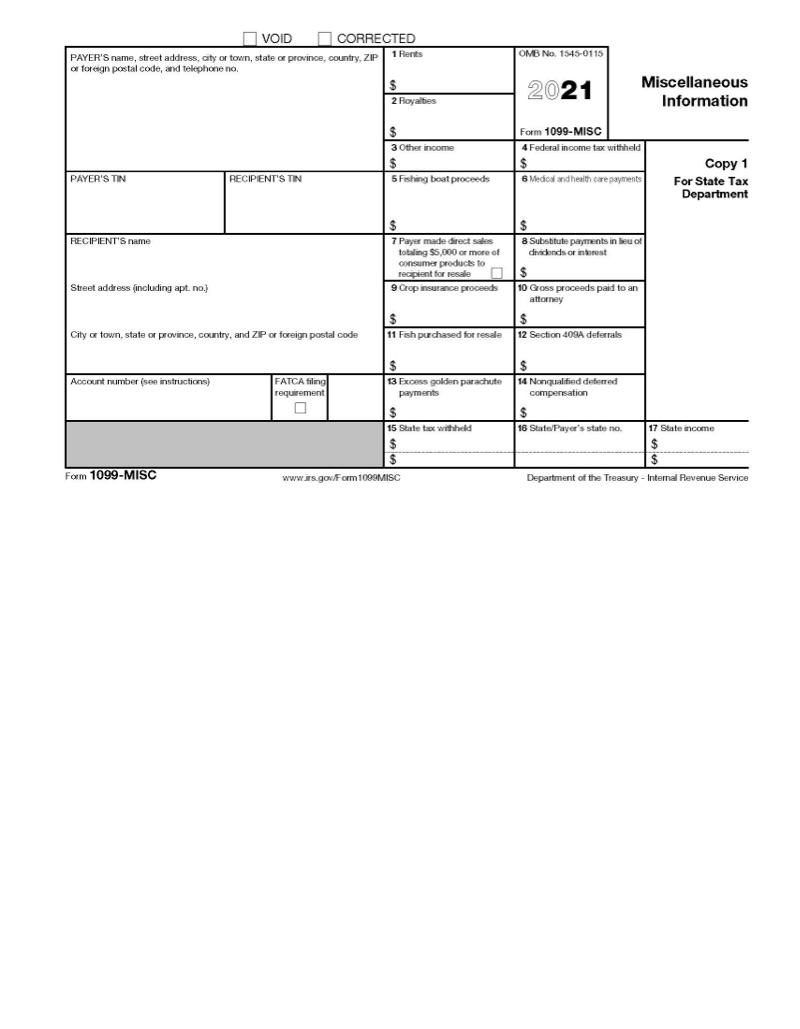

Form 1099-MISC is used to report various types of miscellaneous income that are not reported on other Forms 1099. Many specific types of income often have their own forms in the 1099 series, such as the 1099-R for retirement income and 1099-INT for interest.

For tax years ending after January 1, 2020, Form NEC, Nonemployee Compensation, replaces Form 1099-MISC for payments to independent contractors, gig workers, and other self-employed taxpayers exceeding $600.

1099-MISC is still used for other miscellaneous types of income such as royalties exceeding $10, payments for prizes and compensation for medical studies and market research. If you received rental income exceeding $600 for the year, such as renting out your home through a third party, you may also receive a 1099-MISC reporting the gross rent received.

Should I include a copy of my Forms 1099 with my tax return?

Generally, unless you have federal or state withholding reported on your Forms 1099, you do not have to include them with your tax return.

Do I need to file 1099-MISC for anyone I paid?

If you operate your own business, you need to issue 1099-NEC forms to anyone you paid more than $600 for work performed.

Examples of when Form 1099-MISC should be issued include the following payments:

- Attorney fees for professional services of any amount

- Royalty payments: $10 or greater

- Any other payments exceeding $600, such as prize money or rent

While this list is not exhaustive, they are the most common reasons one would need to send another taxpayer a Form 1099-MISC. The full list of payments warranting a 1099-MISC can be found on the IRS website.

If you made payments of a more personal nature, such as consulting an attorney for personal matters or paying for lawn care services, you do not need to file a 1099-MISC or 1099-NEC.

However, If you regularly pay domestic workers like housekeepers or nannies, and do not pay them through an agency responsible for tax reporting, you may need to register as a household employer and pay them with a W-2 and not a 1099-NEC.

Do I owe self-employment tax on all of my 1099-NEC income?

In most cases, if you are a gig worker, contractor, freelancer, or have other types of self-employment income then you must include all income, whether on a 1099-NEC or not and pay SE taxes on your net profit.

However, if you receive money from a source other than a job, such as prize money on a game show or sweepstakes, you are required to report and pay income tax on the amount reported on Form 1099-MISC. This income is not considered self-employment income, but other income and each type has its own rules concerning deductions and how it’s reported.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.