- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

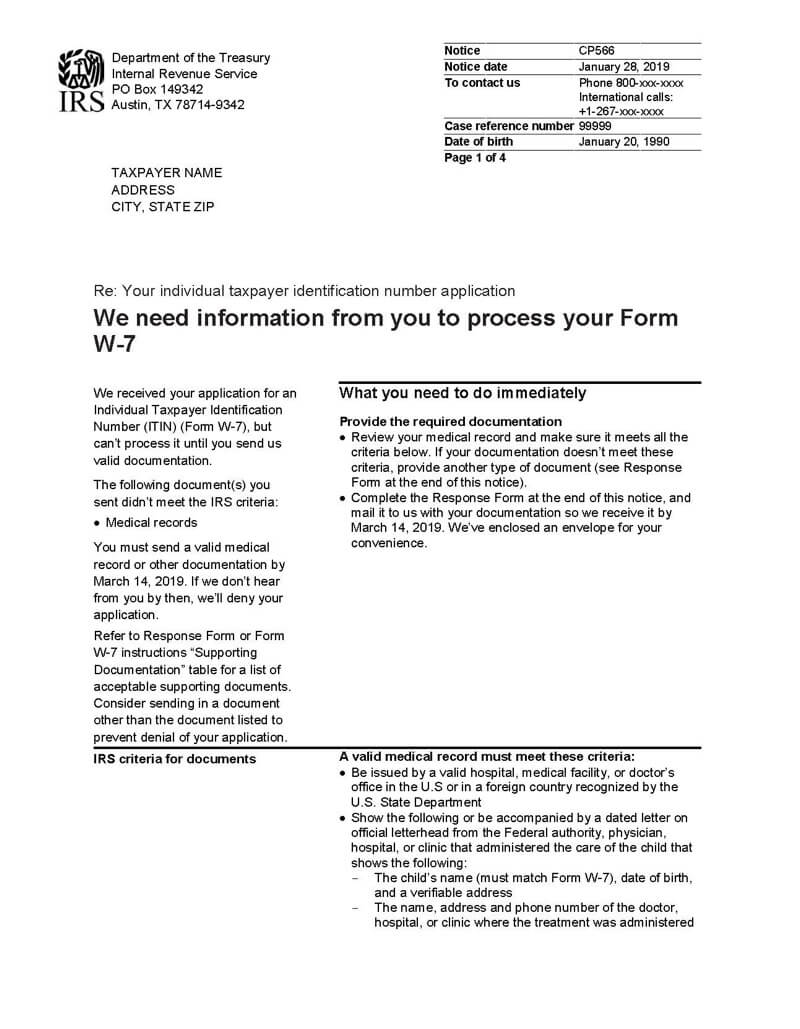

IRS NOTICES: REQUEST FOR INFORMATION

What is a CP566 notice?

IRS notices are letters sent to inform taxpayers of important tax information. Each one is different, but we can explain what the CP566 is about.

Understanding your CP566 notice

You applied for an Individual Taxpayer Identification Number (ITIN) and the IRS needs more information. Likely, your application is incomplete, or you sent the wrong accompanying documents.

Type of Notice

Request for information

Why you received the CP566 notice

You have received a CP566 notice because the IRS needs more information to process your ITIN application.

Likely next steps

As always, read the notice carefully and then review your application for an ITIN to ensure you answered all the questions correctly and provided the correct documentation. You will need to complete and sign the response form at the end of the CP566 notice and mail to the IRS with any accompany documents required for your application.

CP566 Notice deadline

You have 45 days from the date of the CP566 notice to reply with the appropriate information and/or documentation.

If you miss the deadline

The IRS will reject your application for ITIN and you will need to reapply.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.