- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 580-9375 today.

IRS AUDITS & TAX NOTICES

Can Someone Turn Me In to the IRS?

Yes. It is surprisingly easy to do so.

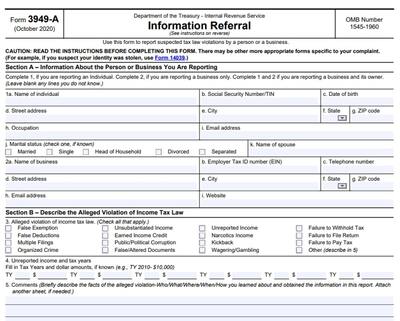

The IRS even has a form for turning in suspected tax cheats: Form 3949-A, Information Referral. The IRS also explains on its website how whistleblowers can report various forms of suspected tax fraud. (Note: whistleblowers can claim a reward using IRS Form 211.)

For years, the IRS and the tax code encouraged whistleblowers to turn in both legal and illegal activity that results in tax fraud. The tax code provides incentives for whistleblowers. Informants may be entitled to a reward if their original information leads to the collection of additional taxes and penalties. Individuals that have information about tax fraud and want to claim a reward should use Form 211.

The IRS also plans to make it easier for informants to report their concerns. They are exploring an online Form 3949-A which would make it easier for informants to submit an online information referral application.

How many people get turned in to the IRS?

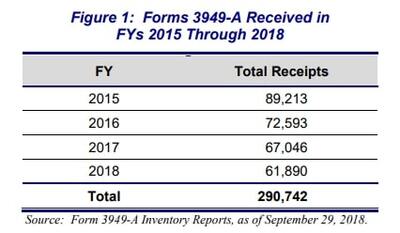

The Treasury Inspector General for Tax Administration (TIGTA) provided some insight on the number of taxpayers turned into the IRS. The TIGTA report provided information on the number of Forms 3949-A received:

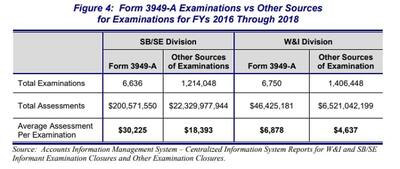

The report also provided data on how many information referrals were audited and the additional assessments from the audits:

The data clearly shows that many informant reports do not result in IRS activity. In fact, the data indicates that only a little more than 6% (FY16-FY18 comparable data) result in an audit.

However, these leads are very fruitful for IRS auditors. The IRS clearly gets a substantial increase in average assessments from its informant-sourced audits vs. other sources of audits. For its Small Business/Self-employed audits, the IRS gets over a 64% increase in its information report sourced audits ($30,225 vs. $18,393).

In addition to audits, the IRS also sends a few of these referrals each year to IRS Criminal Investigation for review. The results of these investigations are not known.

What can a taxpayer be turned in for?

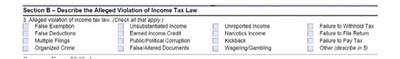

Section B of the Form 3949-A provides the informant a list of violations:

The list is fairly inclusive of most tax fraud situations, and the “other” category provides the informant a catch-all for any further allegations of wrongdoing not covered on the list.

Most quality information referrals come with evidence supporting the allegations. The Form 3949-A allows for the informant to attach the supporting evidence.

What does the IRS do with the information?

Informant referrals are looked at closely by the IRS. However, very few informant referrals make it into the hands of IRS agents for investigation. When the IRS receives the referral, they screen it for routing to specialists throughout the IRS. For example, complicated foreign bank account referrals may go to the IRS’s Large Business and International Division. Unreported income from a small business owner may go to IRS Small Business/Self-employed units.

The IRS can do internal and external research to determine if further action is warranted. For example, an information referral may allege that a taxpayer is a small business non-filer. The informant could provide invoices from the non-filer as evidence that they are in business and their website address. The IRS could review its records to see if the taxpayer filed a return. The IRS can also review the taxpayer’s website and see if they have been in business for the non-filing years. If validated, the IRS can send the report for a non-filer investigation.

What makes a good IRS referral?

A good information referral provides evidence of wrongdoing and an audit trail that the IRS can validate. In short, it provides the auditor a clear line-of-sight to finding the tax fraud activity.

Many information referrals received by the IRS reflect very little evidence of wrongdoing. For example, a competitive business may allege that that their competitor has two sets of books and isn’t reporting all of their sales. In this case, the IRS may be interested but has some practical reservations that the audit would be fruitful because it does not have a specific audit trail to follow. The IRS may also be reluctant to pursue the referral because it may have come from a disgruntled competitor with very little evidence of wrongdoing.

However, if a referral includes specific evidence of wrongdoing—evidence of unreported lines of business that the taxpayer was hiding are good examples—the IRS may be more interested. In addition, the referral is more likely to be accepted if it includes traceable information like a vendor paid in substantial amounts of cash and evidence showing that the subsequent sales were “off the books.” Audit trails are very important.

What can we expect in the future?

The IRS always looks to use its limited audit resources effectively. The IRS likes to start audits that it believes will provide the best return on investment. Good IRS information referrals have always provided the best return on investment.

Taxpayers should always do the right thing and pay their taxes, or they may have to look over their shoulder to see if someone is turning them in to the IRS. For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.