- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 580-9375 today.

IRS AUDITS & TAX NOTICES

7 Things Your IRS Auditor Will Not Tell You

IRS audits are rare these days. Face-to-face audits that involve personal interaction between the IRS auditor and a taxpayer and/or their representative are the least common

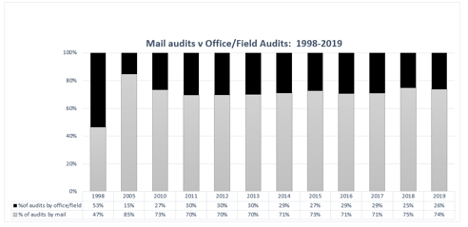

Face-to-face audits (office or field examinations) are the most intrusive IRS tax return investigations. Around 1 out of 4 audits are office or field audits. Many face-to-face audits are saved for businesses, where the IRS cannot rely on W-2’s and 1099’s to track income and the stakes are higher in terms of overall tax exposure.

Because these audits are so rare, many taxpayers and tax professionals have no idea what they are getting into. They imagine an IRS agent who is armed with extensive knowledge and resources at their disposal to enforce tax laws. The reality is most agents treat each audit like a new experience and may not know what they are getting into.

Taxpayers under audit should know the following:

- Many revenue agents are not specialists. Most revenue agents are generalists and they focus on return accuracy issues related to many different types of small businesses and higher-wealth taxpayers. Fortune 500 and large companies, as well as international taxpayers, likely see IRS auditors who are specialized in their industry or issues. But many small business audits are conducted by a revenue agent who has limited knowledge of how the business under audit works. Taxpayers should be prepared to give the auditor a “big picture” about their industry, their competition, their sources of revenue, common expenses, and records kept. Upfront explanations of business conditions and reasons for any large, unusual items on the return should also be explained in the overall context of how the business operates. This may alleviate fishing expeditions by the auditor and cut down audit time and scope and lead to a better outcome for the taxpayer.

- The auditor may not be an expert in accounting or bookkeeping. The taxpayer or tax professional should walk the auditor through how the accounting system works and how the records ultimately reconcile to the tax return. In the end, the auditor will see that the taxpayer has confidence that they have a system of recordkeeping that can be relied on and result in an accurate return.

- Taxpayers should always be aware that the IRS is always on the lookout for tax fraud due to unreported income. In preparation for an audit, taxpayers should try to address any fraud suspicion by conducting the same tests that the agent would in the audit. For example, a common technique is for agents to reconcile bank deposits to income reported in the accounting records. Small businesses should be able to show an income audit trail and explain how their internal controls ensure that all income is reported.

- Overall, 90% of IRS audits result in a change to the return. Prior to a revenue agent auditing a return, several hands have reviewed the return and agreed that there is a high likelihood for a change. One of these people is the revenue agent’s manager who also writes the revenue agent’s evaluation. Revenue agents can “push-back” on the audit selection but rarely do so. One practice to increase the chances of a no-change audit is to prepare for the audit. Many Tax Pros conduct mock audits and “do the work” for the agent. A favorable result is summarized for the agent before the agent has too much time invested. This process greatly improves the chances for a quick no-change.

- The revenue agent is not graded on their ability to collect. Furthermore, there is still a wide division of responsibility and communication between IRS examinations (audits) and IRS collection divisions. For the most part, IRS auditors don’t push to get payment from the taxpayer. They are instructed to request payment, but rarely do they pursue collection. They leave that issue to IRS collection personnel even if the taxpayer can pay in full immediately.

- IRS managers take a closer look at their agent’s cases if the audit has gone on for 6 months or more, or if the statute of limitations to assess additional tax is within a year of expiring. At these timeframes, you can be assured that the agent is starting to feel some pressure to close their audit. The revenue agent may request that the taxpayer extend the statute of limitations. A taxpayer may sign a consent to extend the statute of limitation or may decline to sign the consent. Deciding whether to extend the statute of limitations may have an impact on the audit. The auditor may be more susceptible to agreeing with the taxpayer given their time pressure to close.

- IRS auditors and their managers love agreed cases. Why? Because it saves them hours documenting the case for IRS appeals. It also protects them from criticism of their work and potentially “giving away” their adjustments to the tax return. Appeals can settle issues based on hazards of litigation. Furthermore, there is a firewall between IRS appeals and the agent in which the agent is not aware of how the case is being settled. The agent’s hard work can be quickly settled by an appeals officer without any input from the agent. The agent’s motto: Resolve the issue at their level. This offers opportunity for the taxpayer and their tax professional to come to agreement on the issues at the agent level. The agent’s manager may also be more inclined to work to agree before sending the case to appeals. The moral of the story? Before you request an appeal, ask for a manager conference. You may be happy with the result and save yourself months in the IRS appeals process.

Save face-to-face audits for Tax Pros

When it comes to face-to-face audits, taxpayers that represent themselves may be at a disadvantage. Why? Because the most important mindset of an auditor is that they are auditing the TAXPAYER, not just the tax return. Most taxpayers have no idea about the audit process and how to control the flow of information and what is said and provided to the IRS.

The goal is not to hide information from the IRS, but to have more influence on the scope, depth, and outcome of the examination. Taxpayers should never be put in this position. The best results come when you get an experienced Tax Pro and let them deal with the IRS.

For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.