- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Promotions & Coupons

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

YOU FOCUS ON LIFE. WE’LL HANDLE YOUR RETURNS.

Drop off taxes to an expert Tax Pro

Our hassle-free tax return drop-off option is most convenient for busy lives. Leave your documents with a Tax Pro near you to handle, no need to return for your biggest refund. Simply eSign from the comforts of your home, and you’re done.

How income tax drop-off works

-

1

Book an appointment

Make an appointment for a drop-off time with your local Tax Pro. Or walk in anytime!

-

2

Drop off taxes

Leave your documents with a Tax Pro and go! Our What-to-Bring checklist will prepare you.

-

3

Consult with a Tax Pro

Your local Tax Pro will schedule a quick, 15-minute call to go over your return with you and answer questions.

-

4

Sign & smile

Simply eSign your tax return from the comforts of your home. Feel certain your taxes are done right with our Lifetime Accuracy Guarantee®.

What to bring when you file

A handy checklist of tax documents you’ll need to file your return and get your biggest refund.

- W-2/1099 and any other income docs

- Government-issued ID

- Health Insurance Marketplace Form 1095-A

- Social Security card

Get your personalized document checklist

BECAUSE IT’S YOUR MONEY—FILE NOW!

Find a location near you

We’re in your neighborhood with over 5,200 locations and inside more than 2,600 Walmart stores.

Finding offices near you...

IT’S WRITTEN IN THE STARS

Find out why our clients trust us

most, year after year

4.8 out of 5 star rating

(233,809 customer reviews)

*Actual customer testimonials. Sweepstakes entry offered.

Photos are illustrative only.

TRUSTED. CONVENIENT. EXPERTISE.

5 reasons to trust Jackson Hewitt with your taxes

Expect the best tax preparation experience, year after year.

-

Your biggest refund, guaranteed, or your money back plus $100.

-

Friendly, local Tax Pros do the hard part. You rest easy.

-

We sign your return, too, and guarantee it’s right for life.

-

Over 40 years of experience. Over 60 million returns.

-

Over 5,200 locations open evenings and weekends.

FAQs about our Drop off tax service

TRUSTED. CONVENIENT. EXPERTS.

File taxes your way

File at Jackson Hewitt

We’re in your neighborhood with over 5,200 national locations. Meet your local Tax Pro today.

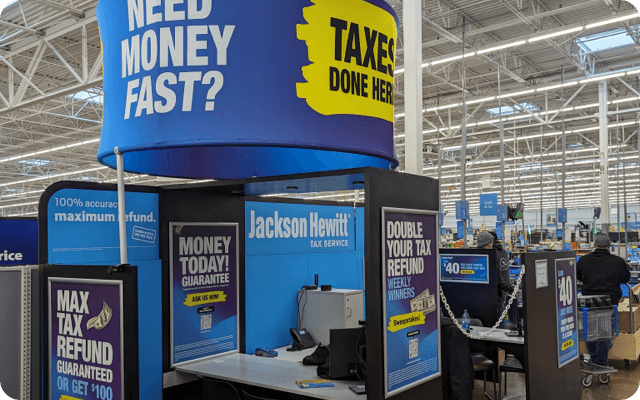

File in Walmart

We’re also in over 2,600 Walmart stores across the nation. File while you shop! Convenient & secure.

When every dollar matters, it matters who does your taxes™

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.

The IRS federal filing deadline ends 11:59pm local time on May 17.

If there is an error preparing your return resulting in an increased tax liability, the local office that prepared your return will reimburse you for penalties and interest (but not additional taxes) owed. You must notify us within 30 days of receiving initial notice from a taxing authority and provide necessary documents and/or assistance. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

If you choose to use eSignature, you must satisfy Jackson Hewitt’s federally mandated identity verification process to review, verify, and sign your tax return. If you do not satisfy this verification process, we will be unable to process your return through eSignature and you must return in-store to sign your tax return.

Ratings from Google Reviews, via Medallia, as of 10/26/23.

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.